-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Reels

-

Статьи пользователей

-

Маркет

-

Jobs

Global Pet Insurance Market Analysis: Coverage Trends and Forecast 2025–2033

Global Pet Insurance Market Overview

According To Renub Research global pet insurance market is experiencing rapid expansion as pet ownership increases and animals are increasingly regarded as integral members of the family. Pet insurance provides financial protection to pet owners by covering a portion of veterinary expenses related to accidents, illnesses, preventive care, and long-term medical conditions. As veterinary medicine becomes more advanced and costly, insurance has emerged as a practical solution to manage unexpected healthcare expenses while ensuring pets receive high-quality treatment.

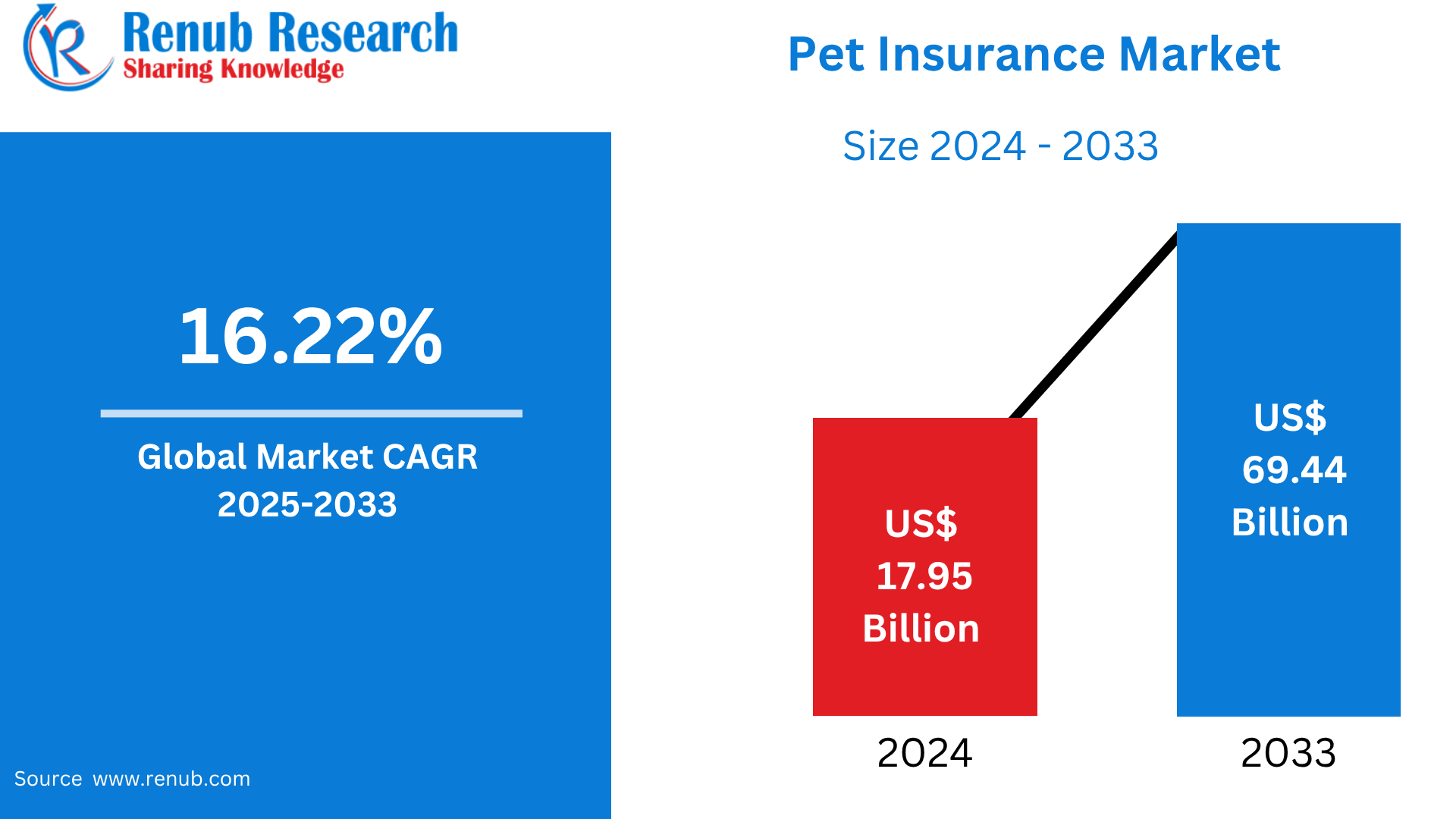

The global pet insurance market was valued at US$ 17.95 billion in 2024 and is projected to reach approximately US$ 69.44 billion by 2033, growing at a strong compound annual growth rate of 16.22% between 2025 and 2033. This impressive growth is driven by rising pet adoption, increasing awareness of pet health, expanding veterinary services, and the growing availability of digital insurance platforms. The market is transitioning from a niche offering into a mainstream financial product across both developed and emerging economies.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=pet-insurance-market-p.php

Global Pet Insurance Market Outlook

Pet insurance functions similarly to human health insurance, reimbursing pet owners for eligible veterinary costs depending on the policy type. Coverage may include treatment for injuries, illnesses, surgeries, medications, diagnostic tests, and routine wellness care. Some policies also extend to dental care, alternative therapies, and behavioral treatments, reflecting the evolving nature of pet healthcare.

The market is witnessing strong growth in regions with high pet ownership rates and advanced veterinary infrastructure. Countries such as the United States, the United Kingdom, Germany, Canada, and Australia lead in adoption due to higher disposable incomes and established insurance awareness. Meanwhile, emerging markets are gradually opening up as urbanization, lifestyle changes, and rising middle-class incomes reshape attitudes toward pet care. The increasing emotional bond between owners and pets, often referred to as pet humanization, is central to this growth trajectory.

Growing Importance of Pet Health and Wellness

Pet owners are becoming more proactive about animal health, focusing not only on treatment but also on preventive care. Regular health checkups, vaccinations, and early diagnosis of chronic conditions are becoming common, driving demand for insurance products that cover preventive services. Longer pet lifespans, achieved through better nutrition and healthcare, further increase the need for sustained medical support over time.

This shift toward comprehensive care has prompted insurers to design flexible policies with add-on features tailored to different life stages and species. As awareness spreads regarding the long-term cost benefits of insurance, adoption rates are expected to rise steadily across diverse demographic groups.

Key Drivers of Growth in the Global Pet Insurance Market

Rising Pet Ownership and Pet Humanization

One of the strongest drivers of the global pet insurance market is the growing number of pet-owning households. Urban lifestyles, smaller family units, and increased emotional reliance on companion animals have led to higher adoption rates worldwide. Pets are increasingly treated as family members, and owners are more willing to invest in their health and comfort.

Millennials and younger generations play a major role in this trend. These groups often delay traditional milestones such as marriage or homeownership and instead channel disposable income toward pet care. This emotional attachment encourages pet owners to seek insurance solutions that provide peace of mind and financial security against rising veterinary costs.

Increasing Cost of Veterinary Care

Veterinary medicine has advanced significantly in recent years, offering sophisticated diagnostic tools, surgical procedures, and specialized treatments comparable to human healthcare. While these advancements improve animal health outcomes, they also increase the cost of care. Treatments such as orthopedic surgery, cancer therapy, and long-term medication can impose substantial financial burdens on pet owners.

Pet insurance helps mitigate these costs by reimbursing a portion of eligible expenses, making high-quality care more accessible. As veterinary costs continue to rise globally, insurance is becoming less of a discretionary product and more of a necessity for responsible pet ownership.

Expansion of Digital and Insurtech Platforms

Digital transformation is reshaping the pet insurance market by simplifying policy purchase, management, and claims processing. Online platforms and mobile applications allow customers to compare plans, receive instant quotes, and file claims electronically. This convenience has significantly lowered barriers to adoption, particularly among tech-savvy consumers.

Insurtech-only providers are leveraging data analytics, artificial intelligence, and automation to offer personalized coverage and faster claim settlements. Digital distribution also enables insurers to reach customers in underserved or geographically dispersed markets, accelerating global expansion.

Challenges in the Global Pet Insurance Market

Limited Awareness in Emerging Markets

Despite rising pet ownership in developing regions, awareness of pet insurance remains relatively low. Many pet owners in these markets are unfamiliar with insurance products or perceive them as unnecessary expenses. Cultural attitudes toward animal healthcare and limited exposure to insurance education further constrain market growth.

Additionally, lower disposable incomes and prioritization of essential spending may reduce willingness to pay insurance premiums. Overcoming these challenges will require targeted awareness campaigns, affordable product offerings, and partnerships with veterinary clinics and pet retailers.

Complexity of Policies and Claims Processes

Policy complexity remains a major challenge for the pet insurance industry. Exclusions, waiting periods, deductibles, and coverage limits can confuse customers and lead to dissatisfaction. Pre-existing condition clauses are particularly contentious, as they may restrict coverage for common ailments.

Delayed or rejected claims can erode trust and discourage renewal or word-of-mouth promotion. Insurers must focus on transparency, simplified policy language, and efficient claims handling to improve customer experience and retention.

Accident and Illness Pet Insurance Segment

Accident and illness policies represent the largest share of the global pet insurance market. These plans cover a broad range of medical scenarios, including injuries, infections, chronic diseases, and surgeries. Their comprehensive nature makes them attractive to pet owners seeking balanced protection against unforeseen health issues.

This segment dominates in regions with high veterinary costs, as it offers significant financial relief while maintaining reasonable premium levels. Continuous innovation in coverage options and reimbursement structures is expected to sustain strong growth in this category.

Chronic and Hereditary Conditions Insurance Segment

Insurance coverage for chronic and hereditary conditions is gaining importance as pets live longer and diagnostic capabilities improve. Conditions such as arthritis, diabetes, heart disease, and breed-specific genetic disorders require ongoing treatment and monitoring.

Policies that address long-term care needs are increasingly valued by pet owners who want predictable healthcare costs over time. As awareness of breed-related health risks grows, demand for such specialized coverage is expected to increase globally.

Dog Pet Insurance Market

Dogs account for the largest share of insured pets worldwide. Their active lifestyles, higher likelihood of injuries, and susceptibility to certain chronic and genetic conditions drive demand for insurance. Larger breeds and pedigree dogs, in particular, often require more frequent and expensive medical care.

Insurers offer a wide range of dog-specific plans, including breed-tailored policies and wellness add-ons. This customization has made dog insurance the most mature and competitive segment within the overall market.

Cat and Other Pet Insurance Market

Although dogs dominate the market, insurance coverage for cats and other pets is steadily expanding. Cats are increasingly kept as indoor companions, and owners are becoming more aware of their healthcare needs. Chronic conditions, dental issues, and age-related illnesses contribute to rising veterinary costs for cats.

Coverage for exotic animals, birds, and equine pets remains niche but is gaining traction among specialized owners. As insurers broaden their offerings, these segments present new opportunities for diversification and growth.

Private Pet Insurance Market

Private insurers lead the global pet insurance market, offering a wide array of policies with flexible coverage levels and optional add-ons. These providers cater primarily to middle- and high-income consumers seeking comprehensive and customizable solutions.

Competition among private insurers is intense, driving innovation in pricing, coverage, and customer service. The entry of new players and partnerships with veterinary networks are further enhancing market dynamism and accessibility.

Direct-to-Consumer Sales Channel

The direct-to-consumer sales channel is growing rapidly due to its convenience and cost efficiency. By eliminating intermediaries, insurers can offer lower premiums and faster service. Online enrollment, digital claims, and customer support through apps or call centers appeal strongly to modern consumers.

This channel is particularly effective in urban areas and developed markets where digital literacy and internet penetration are high. Its continued expansion is expected to reshape distribution strategies across the industry.

United States Pet Insurance Market

The United States represents the largest pet insurance market globally. High pet ownership rates, advanced veterinary services, and increasing consumer awareness drive strong demand. Chronic pet diseases and rising treatment costs further reinforce the need for insurance.

A competitive landscape with established insurers and innovative startups continues to stimulate product development and market growth. Digital infrastructure and employer-sponsored pet benefits are additional factors supporting expansion.

European Pet Insurance Market

Europe is a well-developed pet insurance market, with countries such as Germany, the United Kingdom, and France showing high adoption rates. Strong animal welfare regulations and cultural emphasis on pet health contribute to widespread insurance usage.

An aging pet population and growing popularity of pedigree breeds further increase demand for comprehensive coverage. Europe is also a hub for innovation in preventive care and wellness-focused insurance products.

Asia Pacific Pet Insurance Market

The Asia Pacific region represents a high-growth opportunity for pet insurance providers. Urbanization, rising incomes, and changing lifestyles are driving pet adoption in countries such as China, Japan, India, and Australia.

While awareness remains uneven across the region, digital platforms and targeted education initiatives are helping expand market reach. As veterinary infrastructure improves, insurance adoption is expected to accelerate significantly.

Latin America and Middle East Market Outlook

Latin America and the Middle East are emerging markets with strong long-term potential. Rising disposable incomes, increasing pet humanization, and growing exposure to global trends are reshaping attitudes toward pet healthcare.

Although current penetration remains low, gradual improvements in veterinary services and insurance availability are expected to support future growth. Strategic partnerships and localized offerings will be critical for success in these regions.

Market Segmentation Overview

The global pet insurance market is segmented by policy type into accident and illness, accident-only, wellness and preventive-care add-ons, and chronic or hereditary condition coverage. By animal type, the market includes dogs, cats, and other pets. Provider segmentation covers private insurers, mutual or cooperative insurers, insurtech-only providers, and government-linked schemes.

Sales channels include direct-to-consumer, intermediated distribution, and embedded insurance through pet retailers, veterinary clinics, and e-commerce platforms. Regional segmentation spans North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Future Outlook of the Global Pet Insurance Market

The global pet insurance market is poised for sustained and robust growth through 2033. Rising awareness of pet health, expanding veterinary capabilities, and digital innovation will continue to drive adoption. While challenges related to awareness and policy complexity persist, ongoing education and product simplification are expected to improve market penetration.

As pets increasingly become valued family members, demand for reliable and comprehensive insurance solutions will strengthen. The market’s future will be shaped by innovation, customer-centric design, and the growing recognition of pet insurance as an essential component of responsible pet ownership.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar