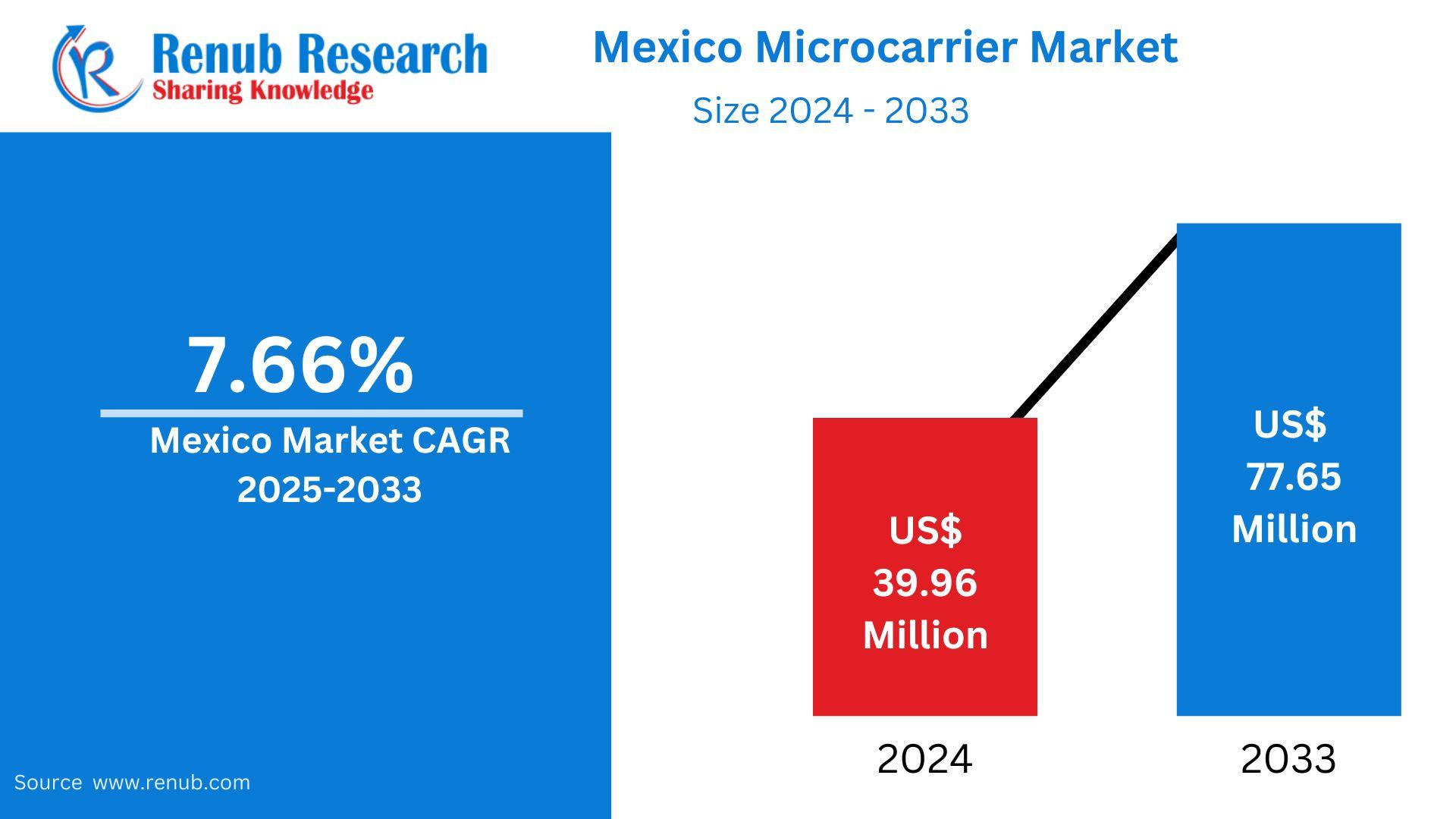

Mexico Microcarrier Market Outlook: US$77.65M by 2033 at 7.66% CAGR

Mexico Microcarrier Market Size and Forecast 2025–2033

According To Renub Research Mexico microcarrier market is poised for steady and sustained growth as the country strengthens its biopharmaceutical and biotechnology ecosystem. The market was valued at approximately US$ 39.96 million in 2024 and is projected to reach nearly US$ 77.65 million by 2033, registering a compound annual growth rate of 7.66% during the period from 2025 to 2033. This expansion is driven by rising investments in regenerative medicine, increasing demand for cell-based vaccines and biologics, technological improvements in cell culture efficiency, and the gradual expansion of biopharmaceutical research and development activities across Mexico.

Microcarriers have become an essential component in modern cell culture and bioprocessing workflows, enabling large-scale production of adherent cells required for advanced therapies. As Mexico aims to enhance healthcare self-sufficiency and reduce reliance on imported biologics, the adoption of microcarrier-based systems is becoming increasingly important for both research and commercial manufacturing applications.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=mexico-microcarrier-market-p.php

Mexico Microcarrier Market Overview

Microcarriers are small, spherical particles designed to support the growth of adherent cells in suspension-based bioreactors. They significantly increase surface area for cell attachment, allowing high-density cell cultures within compact bioprocessing systems. These systems are widely used in the production of vaccines, biologics, therapeutic proteins, and cell therapies, making microcarriers a critical enabling technology in modern biomanufacturing.

In Mexico, the microcarrier market is closely tied to the country’s growing life sciences sector. Government initiatives focused on strengthening domestic pharmaceutical manufacturing and improving access to advanced therapies have increased interest in scalable cell culture technologies. The rise in chronic diseases, an aging population, and greater emphasis on personalized medicine further elevate demand for efficient biologics production platforms.

Mexico’s participation in international research collaborations and global health initiatives has also improved access to advanced biotechnologies. While the market still faces challenges related to technical expertise and regulatory complexity, these obstacles are encouraging innovation, workforce development, and stronger public–private partnerships within the biopharmaceutical sector.

Key Factors Driving the Mexico Microcarrier Market Growth

Increasing Demand for Cell Therapy and Biopharmaceuticals

One of the most important drivers of the Mexico microcarrier market is the rising demand for cell therapies, vaccines, and biopharmaceutical products. As local pharmaceutical and biotechnology companies expand their research pipelines, the need for scalable and efficient cell culture systems has increased significantly. Microcarriers enable high-density adherent cell growth, which is essential for commercial-scale production of biologics and regenerative medicine products.

This demand is particularly evident in the development of therapeutic proteins, monoclonal antibodies, and advanced cell-based treatments. Microcarrier systems allow manufacturers to achieve consistent quality, improved yields, and better process control, which are critical for meeting regulatory and clinical requirements. As Mexico aligns its healthcare manufacturing goals with international standards, microcarrier-based technologies are becoming indispensable to biomanufacturing operations.

Infrastructure Development and Manufacturing Expansion

Mexico has made notable progress in strengthening its bioprocessing infrastructure through government-backed initiatives and public–private collaborations. Investments in upstream bioprocessing facilities, automation, single-use technologies, and digital integration are supporting the adoption of advanced cell culture systems. These improvements enhance production efficiency and reduce contamination risks, making microcarrier systems more attractive to manufacturers.

The expansion of partnerships between industry and academic institutions further accelerates innovation and technology transfer. Regulatory modernization efforts, including digital transformation initiatives, are helping streamline approvals and improve operational readiness. Together, these developments create a favorable environment for scaling complex bioprocesses and expanding microcarrier adoption across pharmaceutical companies, contract manufacturers, and research institutions.

Innovation and Technological Progress in Microcarriers

Technological advancements in microcarrier design have significantly improved performance, scalability, and compatibility with modern bioprocessing platforms. Innovations such as surface-functionalized beads, biodegradable microcarriers, and formats optimized for single-use bioreactors are enhancing cell adhesion, growth efficiency, and downstream processing.

Automation, smart sensor integration, and digital process monitoring further reduce human error and improve reproducibility. These innovations are particularly valuable in Mexico, where manufacturers are increasingly aligning with global industry standards. As access to advanced bioprocessing infrastructure grows, modern microcarrier technologies are becoming viable and cost-effective solutions for a wide range of applications nationwide.

Challenges in the Mexico Microcarrier Market

Expensive Startup and Ongoing Costs

Despite their advantages, microcarrier-based cell culture systems require significant upfront investment. Equipment such as bioreactors, single-use systems, and supporting infrastructure involves high capital expenditure, which can be a barrier for smaller biotechnology companies and academic institutions. Traditional planar culture methods remain more affordable at small scales, limiting early adoption.

Ongoing operational costs also present challenges. Consumables, particularly high-quality microcarrier beads, represent a substantial portion of recurring expenses. In many cases, consumables can account for a significant share of total production costs, especially for processes requiring good manufacturing practice compliance. These financial constraints can slow adoption, even though microcarriers offer long-term efficiency and scalability benefits.

Complexity of Regulations and Documentation Needs

Regulatory compliance represents another key challenge in the Mexican microcarrier market. Microcarrier-based cell culture systems used for clinical or therapeutic applications must meet strict quality, safety, and documentation requirements. Companies are required to prepare extensive technical dossiers covering non-clinical, clinical, and quality data in accordance with international guidelines.

Compliance with national manufacturing and safety standards requires thorough validation of microcarrier systems, including sterility testing, batch consistency, and cell-material interaction assessments. Regulatory uncertainty and evolving standards for advanced therapies can increase development timelines and costs. For organizations without prior regulatory experience or local partnerships, navigating these requirements can delay commercialization and market entry.

Mexico Microcarrier Market Overview by Regions

Northern Mexico Microcarrier Market

Northern Mexico represents a growing hub for microcarrier adoption due to its strong industrial base and proximity to international markets. The region benefits from cross-border collaboration, knowledge exchange, and access to skilled labor. Industrial and research clusters in cities such as Monterrey support biopharmaceutical development and advanced manufacturing.

Universities and research centers in the region are increasingly involved in regenerative medicine and cell therapy research, driving demand for scalable cell culture solutions. Government support for innovation and infrastructure modernization further strengthens the market. Contract manufacturing organizations in northern Mexico are adopting microcarrier-based systems to improve efficiency and meet international production standards, making the region a strategic location for market growth.

Central Mexico Microcarrier Market

Central Mexico is a key driver of microcarrier adoption, supported by its concentration of academic institutions, pharmaceutical companies, and biotechnology startups. Metropolitan and research hubs contribute significantly to demand through projects focused on vaccine development, regenerative medicine, and advanced biologics.

Government incentives and the development of biotechnology parks in central states encourage local production using modern cell culture platforms. Efficient logistics infrastructure and proximity to regulatory authorities enable faster technology adoption and decision-making. Contract development and manufacturing organizations in the region are integrating microcarrier systems to support large-scale production, positioning Central Mexico as a core market for microcarrier technologies.

Southern Mexico Microcarrier Market

The microcarrier market in southern Mexico is emerging at a gradual pace. While adoption remains lower compared to northern and central regions, growing interest from public research institutions and regional universities is creating new opportunities. Efforts to expand biologics manufacturing capacity and support cell-based research are contributing to early-stage demand.

State-level initiatives aimed at improving infrastructure and attracting biotech investment are beginning to support market development. The region’s access to major ports enhances its long-term potential for contract manufacturing and export-oriented production. With strategic investment and institutional support, southern Mexico is positioned to become a promising growth area for microcarrier adoption.

Market Segmentations

Product Type

By product type, the market is segmented into consumables and equipment. Consumables include microcarrier beads as well as media and reagents, which account for a significant share of recurring demand. Equipment includes bioreactors and associated systems required for microcarrier-based cell culture. Consumables dominate the market due to continuous usage in research and production processes.

Application

Based on application, the market is categorized into cell therapy, vaccine manufacturing, and other uses. Cell therapy represents a major growth segment due to increasing focus on regenerative medicine and personalized treatments. Vaccine manufacturing also contributes significantly, supported by public health initiatives and domestic production goals.

End User

End users include pharmaceutical and biotechnology companies, contract research and contract manufacturing organizations, and academic and research institutes. Pharmaceutical and biotechnology companies lead demand due to large-scale production needs, while academic institutions contribute through research and early-stage development activities.

Regions

Regionally, the market is divided into Northern Mexico, Central Mexico, Southern Mexico, and other areas. Central and Northern Mexico currently dominate due to stronger infrastructure and industry presence, while Southern Mexico represents an emerging growth opportunity.

Competitive Landscape

The Mexico microcarrier market is moderately competitive, with global and regional players supplying consumables, equipment, and integrated solutions. Companies focus on product innovation, technical support, and strategic partnerships to strengthen their market position. Key competitive strategies include expanding local distribution networks, supporting regulatory compliance, and offering scalable solutions tailored to the needs of Mexican biomanufacturers.

Overall, the Mexico microcarrier market is set for sustained growth as investments in biotechnology, regenerative medicine, and biologics manufacturing continue to rise. While cost and regulatory challenges remain, ongoing infrastructure development, innovation, and policy support are expected to create a favorable environment for long-term market expansion.

Top of Form

Bottom of Form

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar