Australia Urea Market: Fertilizer Demand, Pricing Trends, and Outlook

Australia Urea Market Overview

According To Renub Research Australia urea market forms a critical component of the country’s agricultural and industrial input landscape. Urea is a nitrogen-rich compound widely used as a fertilizer due to its high nitrogen concentration, making it one of the most efficient sources of nitrogen for crop production. With nitrogen being a key nutrient for plant growth, urea plays a vital role in improving soil fertility, crop yield, and overall agricultural productivity across Australia’s diverse farming regions.

Australia’s agricultural sector, which includes broadacre cropping, livestock farming, and horticulture, relies heavily on urea-based fertilizers to maintain competitiveness in global food markets. In addition to agriculture, urea is also used in industrial applications such as chemical manufacturing and diesel exhaust fluid production. Despite its importance, Australia remains highly dependent on imported urea, exposing the market to global supply chain disruptions and price volatility. As a result, policy discussions around domestic production, storage infrastructure, and fertilizer security are increasingly shaping the future of the market.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=australia-urea-market-p.php

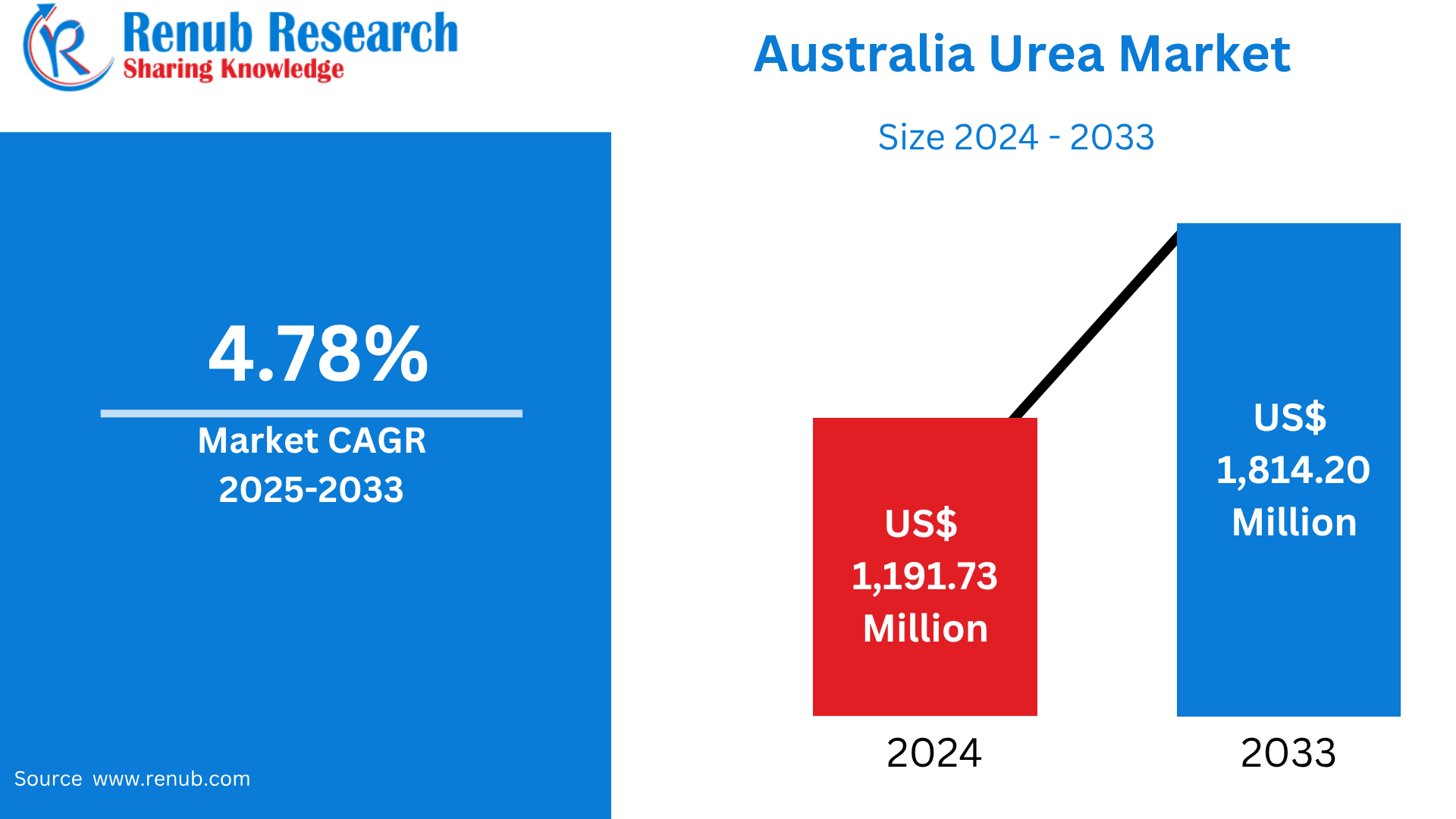

Australia Urea Market Size and Forecast 2025–2033

The Australian urea market is expected to grow steadily over the forecast period, reaching an estimated value of US$ 1,814.20 million by 2033, up from US$ 1,191.73 million in 2024. This growth reflects a compound annual growth rate of 4.78% between 2025 and 2033. The upward trend is supported by rising fertilizer demand from agriculture, expanding grain and crop cultivation, and increasing awareness of soil nutrient management.

Population growth, export-oriented farming, and the need to improve agricultural efficiency are driving consistent demand for nitrogen fertilizers. Government incentives promoting sustainable farming practices and productivity improvements are also supporting market expansion. Furthermore, initiatives aimed at reducing import dependence through potential local production are influencing long-term market dynamics. Together, these factors position the Australian urea market for stable and sustained growth over the next decade.

Role of Urea in Australian Agriculture

Urea is one of the most widely used fertilizers in Australian agriculture due to its high nitrogen content, cost-effectiveness, and ease of application. With approximately 46% nitrogen, urea offers farmers a concentrated and efficient nutrient source that supports strong plant growth and improved crop yields. It is commonly applied to cereal crops such as wheat, barley, and canola, as well as to pasturelands supporting livestock production.

Australia’s soil profiles are often nitrogen-deficient, particularly in dryland farming regions. Urea helps address this limitation by replenishing nitrogen levels and supporting sustainable crop rotations. Its versatility allows it to be used in both solid and liquid forms, and it is frequently blended with other fertilizers to optimize nutrient delivery. As food security and agricultural productivity remain national priorities, urea continues to be a cornerstone of Australian farming systems.

Growth Drivers in the Australia Urea Market

Increasing Demand from the Agricultural Sector

The primary driver of the Australian urea market is the country’s strong agricultural base. Broadacre farming, horticulture, and livestock production all depend on nitrogen fertilizers to maintain output levels. Rising global demand for grains, oilseeds, and animal products has encouraged Australian farmers to increase productivity, thereby boosting urea consumption.

Urea’s affordability and high nutrient concentration make it the preferred nitrogen fertilizer for both small-scale and large commercial farms. As farmers focus on yield optimization and efficient land use, the application of urea remains central to modern agricultural practices. Continued investment in crop improvement and export-oriented agriculture is expected to sustain long-term demand.

Government Support for Fertilizer Security and Sustainability

The Australian government plays an active role in supporting fertilizer availability and sustainable agricultural practices. Policies aimed at improving fertilizer security, reducing supply chain risks, and promoting responsible nutrient use are shaping the urea market. Programs such as soil health initiatives and agricultural innovation funding encourage efficient fertilizer application while minimizing environmental impacts.

Government interest in reducing dependence on imported fertilizers has also renewed discussions around domestic urea production and storage infrastructure. These measures are designed to protect farmers from global price volatility and supply disruptions. As sustainability and resilience become key policy priorities, government support is expected to strengthen the urea market across rural and regional Australia.

Growth of Livestock and Animal Feed Industries

Australia’s expanding livestock sector is another important contributor to urea demand. Urea is widely used in animal feed as a non-protein nitrogen source, particularly for ruminants such as cattle and sheep. It enhances microbial activity in the rumen, improving the digestion of low-quality forage and crop residues.

This application is especially valuable during drought conditions or in regions with limited pasture quality. As demand for meat and dairy products increases domestically and internationally, feed efficiency has become a key focus for producers. Urea’s dual role as both a fertilizer and feed additive strengthens its position within Australia’s integrated agricultural systems.

Challenges in the Australia Urea Market

Heavy Dependence on Imports and Price Volatility

One of the most significant challenges facing the Australian urea market is its reliance on imports. The majority of urea consumed in Australia is sourced from overseas suppliers, making the market vulnerable to global supply chain disruptions, geopolitical tensions, and shipping delays. Fluctuations in international energy prices also directly affect urea production costs and import prices.

These factors can lead to sudden price increases, placing financial pressure on farmers and affecting cropping decisions. The lack of large-scale domestic production limits Australia’s ability to control supply and stabilize prices. Addressing this challenge will require long-term investment in local manufacturing capacity and diversified sourcing strategies.

Environmental and Regulatory Constraints

Environmental concerns associated with nitrogen fertilizer use present another challenge for the urea market. Excessive or improper application can result in nitrogen runoff, greenhouse gas emissions, and soil degradation. In response, regulatory oversight on fertilizer use is increasing across Australia.

Farmers are being encouraged to adopt precision agriculture techniques and comply with stricter environmental standards. While these measures support sustainable farming, they may increase operational costs and require investment in new technologies and training. Balancing productivity with environmental responsibility remains an ongoing challenge for the widespread use of urea.

Australia Fertilizer Grade Urea Market

Fertilizer-grade urea represents the largest segment of the Australian urea market, driven by its extensive use in crop cultivation and pasture management. This grade is favored for its high nitrogen concentration and compatibility with other fertilizers, making it suitable for a wide range of agricultural applications.

Farmers apply fertilizer-grade urea in both granular and liquid forms, often as part of integrated nutrient management programs. It supports high-yield crops and contributes to soil fertility improvement. Government support for precision farming and soil health initiatives further reinforces demand for fertilizer-grade urea, positioning this segment for steady growth.

Australia Agriculture Urea Market

The agriculture sector is the dominant consumer of urea in Australia. Broadacre cropping systems, particularly in wheatbelt regions, rely heavily on nitrogen fertilizers to address soil nutrient deficiencies. Urea is also essential in rotational cropping and conservation agriculture practices.

Seasonal factors such as rainfall patterns and planting cycles influence application rates, but long-term demand remains stable due to the sector’s focus on productivity and sustainability. As Australian agriculture continues to evolve toward efficient and climate-resilient systems, urea will remain a foundational input supporting food production.

Australia Animal Feed Urea Market

Urea’s role in animal feed is increasingly important within Australia’s livestock industry. Used primarily for ruminants, feed-grade urea provides an economical source of nitrogen that improves digestion and feed efficiency. Its use is carefully regulated to ensure animal safety and optimal dosing.

The expansion of feedlot operations and growing meat exports are driving increased attention to feed-grade urea. By enhancing the nutritional value of low-quality feed, urea supports livestock productivity and profitability. This segment is expected to gain further traction as producers seek cost-effective feed solutions.

New South Wales Urea Market

New South Wales is one of Australia’s largest urea-consuming states, supported by extensive grain farming and livestock production. Wheat, barley, sheep, and cattle operations contribute to consistent fertilizer demand throughout the year. Variable rainfall patterns increase the need for effective nitrogen management, reinforcing the importance of urea.

The state’s strong agricultural infrastructure and logistics networks facilitate efficient distribution and application. Sustainability programs and best-practice farming initiatives further support responsible fertilizer use, maintaining New South Wales as a key regional market.

Victoria Urea Market

Victoria’s urea market is driven by intensive dairy farming, horticulture, and high-value crop production. The state’s fertile soils and temperate climate support intensive agricultural practices, making urea an essential productivity input.

Farmers use urea extensively for pasture renewal, silage production, and crop fertilization. The growing adoption of precision agriculture and fertigation systems in Victoria enhances nutrient efficiency and supports sustainable growth in urea consumption.

South Australia Urea Market

South Australia’s dryland farming systems rely heavily on urea to support cereal crop production. Low rainfall and nutrient-poor soils increase dependence on nitrogen fertilizers to maintain yields. Farmers commonly apply urea through pre-seeding and top-dressing methods.

Research institutions and extension programs in the state promote strategic fertilizer use to manage climate variability. These efforts contribute to stable demand for fertilizer-grade urea across South Australia’s agricultural regions.

Queensland Urea Market

Queensland’s diverse agricultural profile makes it one of Australia’s most significant urea markets. Sugarcane, cotton, grains, and livestock farming all require substantial nitrogen inputs. Sugarcane cultivation, in particular, drives high urea usage due to its intensive nutrient requirements.

Multiple cropping seasons and extensive pasture development support consistent fertilizer demand. Government-backed nutrient management initiatives encourage responsible use, supporting market growth while addressing environmental concerns.

Australia Urea Market Segmentation

The Australian urea market is segmented by type, application, and geography. By type, the market includes technical grade, fertilizer grade, and feed-grade urea. Fertilizer grade dominates due to its widespread agricultural use. By application, the market is divided into agriculture, chemical synthesis, animal feed, and other uses.

Geographically, demand is spread across key agricultural states such as New South Wales, Victoria, Queensland, Western Australia, and South Australia, along with smaller contributions from other regions. This diversified segmentation highlights the broad and sustained demand base supporting Australia’s urea market.

Competitive Landscape and Key Players

The competitive landscape of the Australian urea market includes global fertilizer manufacturers and suppliers with strong import and distribution networks. Market participants focus on supply reliability, pricing strategies, and sustainability initiatives to maintain competitiveness.

Key players emphasize product quality, logistics efficiency, and customer support while exploring opportunities for local production and long-term supply agreements. Ongoing investments in infrastructure, partnerships, and innovation are expected to shape competition and ensure stable market development during the forecast period.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar