-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Reels

-

Blogs

-

Marketplace

-

Jobs

Australia Commercial Vehicle Market: Fleet Demand Trends and Outlook

Australia Commercial Vehicle Market Size and Forecast 2025–2033

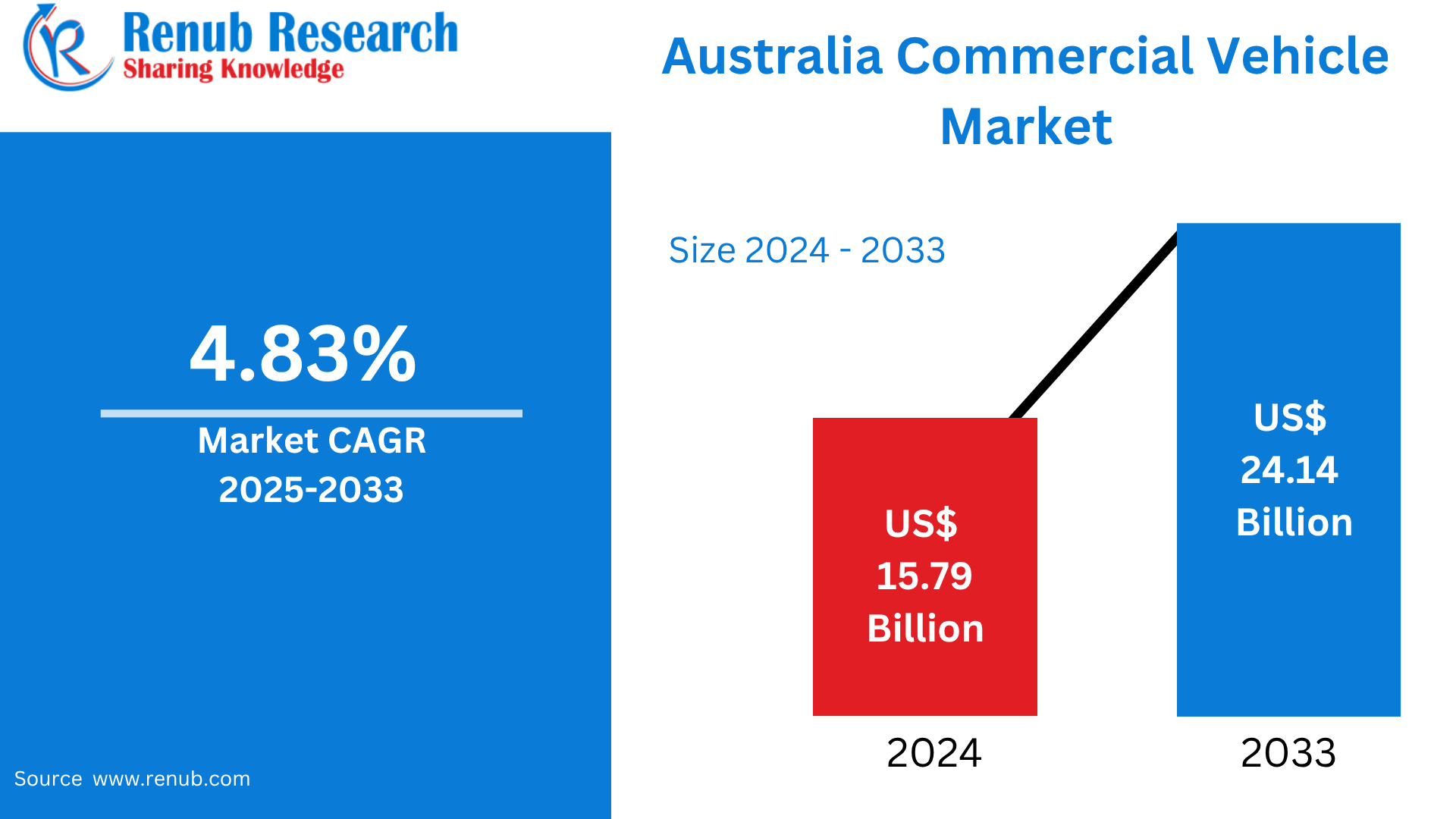

According To Renub Research Australia commercial vehicle market is positioned for steady and sustained growth over the forecast period, driven by expanding freight requirements, large-scale infrastructure development, and the rising adoption of cleaner vehicle technologies. The market is projected to increase from US$ 15.79 billion in 2024 to US$ 24.14 billion by 2033, registering a compound annual growth rate of 4.83% between 2025 and 2033. Australia’s vast geography, reliance on road-based logistics, and strong industrial base make commercial vehicles a critical enabler of economic activity across urban, regional, and remote areas.

Australia Commercial Vehicle Market Overview

A commercial vehicle is primarily designed for the transportation of goods or passengers for business and industrial purposes. In Australia, commercial vehicles include light commercial vans, utility vehicles, medium-duty trucks, heavy-duty trucks, and buses. These vehicles are extensively used across logistics, construction, mining, agriculture, public transport, and municipal services.

Australia’s economic structure and geographic scale make road transport indispensable for domestic trade and interstate connectivity. From heavy trucks operating in mining regions to delivery vans supporting urban e-commerce, commercial vehicles ensure the smooth functioning of supply chains. Growing population centers, expanding industrial activity, and government-led infrastructure projects continue to reinforce demand for modern, efficient, and reliable commercial vehicle fleets.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=australia-commercial-vehicle-market-p.php

Key Growth Drivers in the Australia Commercial Vehicle Market

Infrastructure Development and Urban Expansion

Infrastructure investment remains one of the most influential drivers of commercial vehicle demand in Australia. Federal and state governments are allocating substantial budgets toward roads, highways, rail corridors, and urban transit systems. Large-scale projects require a consistent supply of heavy-duty trucks, construction vehicles, and specialized transport equipment.

Rapid urban expansion in major cities has also increased the need for delivery vehicles, waste collection trucks, and public transport buses. The development of national freight corridors and intermodal hubs further strengthens demand by improving connectivity between ports, cities, and industrial zones. These investments generate long-term demand for both new vehicle purchases and fleet replacements.

E-commerce Growth and Last-Mile Delivery Demand

The rapid expansion of e-commerce has significantly reshaped Australia’s logistics landscape. Online retail growth has increased parcel volumes and accelerated the need for efficient last-mile delivery solutions. Light commercial vehicles and medium-duty trucks are now essential assets for courier companies, retailers, and third-party logistics providers.

Consumers increasingly expect faster delivery times and flexible shipping options, prompting businesses to invest in modern vehicle fleets that improve reliability and cost efficiency. As urban delivery density rises, demand for compact, fuel-efficient, and electric delivery vans is expected to grow steadily.

Transition Toward Green Mobility and Fleet Electrification

Australia’s commercial vehicle market is undergoing a gradual but meaningful transition toward low-emission and alternative-fuel vehicles. Environmental regulations, corporate sustainability targets, and rising fuel costs are encouraging fleet operators to explore battery electric vehicles, hybrids, and alternative fuels such as CNG and LPG.

Government incentives, including rebates and tax benefits, are supporting early adoption of electric buses and delivery vehicles, particularly in metropolitan areas. While diesel continues to dominate heavy-duty applications, electrification is gaining traction in urban logistics and public transport, reshaping long-term market dynamics.

Challenges in the Australia Commercial Vehicle Market

High Ownership and Operating Costs

Operating commercial vehicles in Australia involves significant expenses related to fuel, maintenance, insurance, and labor. Long travel distances, harsh operating environments, and varied terrain increase wear and tear, leading to higher maintenance requirements. The high upfront cost of new vehicles, particularly electric and technology-intensive models, can be a barrier for small and medium fleet operators.

Rising fuel prices and labor shortages further pressure operating margins, especially in logistics and construction sectors. These cost challenges can slow fleet expansion and delay replacement cycles.

Limited Charging and Alternative Fuel Infrastructure

Although interest in electric and alternative-fuel commercial vehicles is increasing, infrastructure development has not kept pace with demand. Charging networks for electric vehicles remain limited outside major cities, and refueling infrastructure for CNG and LPG is unevenly distributed.

This lack of coverage is particularly challenging in regional and remote areas, where long distances and limited service availability create range anxiety and operational constraints. Infrastructure gaps remain a key obstacle to large-scale adoption of low-emission commercial vehicles.

Australia Heavy-Duty Commercial Truck Market

Heavy-duty commercial trucks form the backbone of Australia’s mining, construction, agriculture, and long-haul freight industries. These vehicles are engineered for high payloads and extended operation across challenging terrains. Strong demand is evident in mining-intensive regions and freight corridors that connect ports to inland distribution centers.

While diesel-powered trucks continue to dominate this segment, growing concerns about emissions and fuel efficiency are driving interest in cleaner diesel technologies and future alternatives such as electric and hydrogen-powered trucks. Fleet modernization and regulatory pressure are expected to gradually influence purchasing decisions.

Australia Battery Electric Commercial Vehicle Market

The battery electric commercial vehicle segment is still at an early stage in Australia but shows strong long-term potential. Electric vans and buses are increasingly used in city logistics and public transport due to their low operating costs and zero tailpipe emissions. Pilot programs and fleet trials are helping operators evaluate performance, range, and total cost of ownership.

High initial costs and limited vehicle availability currently restrict rapid adoption. However, as charging infrastructure improves and incentives expand, electric commercial vehicles are expected to gain a larger market share, particularly in urban applications.

Australia CNG Commercial Vehicle Market

Compressed natural gas commercial vehicles offer a cleaner alternative to diesel, especially for buses and waste collection fleets. Several Australian cities operate CNG-powered public transport vehicles to reduce emissions and fuel costs. Despite environmental benefits, limited refueling infrastructure restricts broader adoption.

Fleet operators remain cautious due to supply chain constraints and infrastructure gaps. Nevertheless, targeted government support and urban emission reduction goals may sustain demand in selected metropolitan markets.

Australia LPG Commercial Vehicle Market

LPG-powered commercial vehicles have traditionally been used in taxis, courier fleets, and utility vehicles. LPG offers lower fuel costs and reduced emissions compared to petrol and diesel. However, the segment is gradually declining as electric vehicle adoption increases and LPG infrastructure investment slows.

While LPG remains relevant for cost-sensitive operators, its long-term growth prospects are limited unless technological improvements and policy support revive market interest.

Australia Logistics Commercial Vehicle Market

Logistics is a core driver of commercial vehicle demand in Australia. Growth in domestic trade, international freight, and e-commerce has increased reliance on light, medium, and heavy-duty trucks. Distribution centers, ports, and intermodal hubs depend on efficient vehicle fleets to maintain supply chain continuity.

Advanced fleet management technologies such as telematics, route optimization, and real-time tracking are becoming standard, improving efficiency and safety. Despite challenges such as driver shortages and fuel price volatility, demand for logistics vehicles remains strong.

Australia Mining and Construction Commercial Vehicle Market

Mining and construction industries are among the largest consumers of heavy-duty commercial vehicles in Australia. These sectors require robust trucks for hauling materials, equipment transport, and workforce mobility. Demand is closely tied to infrastructure investment cycles and global commodity prices.

There is increasing emphasis on safety, fuel efficiency, and emissions reduction, driving interest in advanced vehicle technologies. Autonomous and semi-autonomous mining trucks are also emerging, improving productivity and reducing operational risks.

New South Wales Commercial Vehicle Market

New South Wales represents the largest and most diversified commercial vehicle market in Australia. The state’s strong logistics network, ports, and infrastructure projects create sustained demand across all vehicle categories. Urban delivery vans are in high demand in Sydney, while regional areas rely on heavy trucks for agriculture and mining.

Government initiatives promoting electric buses and low-emission fleets are influencing procurement trends. New South Wales remains a leader in adopting cleaner and more technologically advanced commercial vehicles.

Victoria Commercial Vehicle Market

Victoria, anchored by Melbourne, is a major hub for logistics, manufacturing, and urban transport. Strong retail activity and e-commerce growth drive demand for light and medium-duty commercial vehicles. The Port of Melbourne supports heavy-duty freight movement, sustaining demand for haulage trucks.

Public transport electrification and environmental regulations are shaping fleet decisions, although congestion and infrastructure constraints present ongoing challenges.

South Australia Commercial Vehicle Market

South Australia has a smaller but steadily growing commercial vehicle market. Agriculture, regional logistics, and renewable energy projects support demand for light and heavy-duty vehicles. Adelaide’s urban logistics sector is expanding, increasing interest in electric delivery vans.

While long distances and limited model availability pose challenges, investments in clean energy and transport innovation are gradually reshaping fleet preferences.

Market Segmentation Analysis

Vehicle Type Segmentation

The Australia commercial vehicle market includes heavy-duty trucks, medium-duty trucks, light commercial vans, and pickup trucks. Each category serves distinct operational needs across logistics, construction, and passenger transport.

Propulsion Type Segmentation

Propulsion types include diesel, gasoline, LPG, CNG, hybrid electric vehicles, battery electric vehicles, and fuel cell electric vehicles. Diesel remains dominant, but alternative propulsion technologies are gaining traction due to sustainability goals.

End-User Segmentation

Key end users include logistics operators, mining and construction companies, industrial users, passenger transport providers, and municipal services. Each segment exhibits unique demand patterns based on operational requirements and regulatory pressures.

Competitive Landscape and Key Players

The Australian commercial vehicle market features a mix of global manufacturers and regional suppliers competing on reliability, fuel efficiency, and technological innovation. Key players include AB Volvo, Toyota Motor Corporation, Mercedes-Benz Group AG, Ford Motor Company, Hyundai Motor Company, and Tata Motors Limited. These companies focus on fleet solutions, alternative propulsion technologies, and aftersales support to strengthen their market position.

Future Outlook of the Australia Commercial Vehicle Market

The Australia commercial vehicle market is expected to maintain steady growth through 2033, supported by infrastructure development, logistics expansion, and gradual electrification. While cost pressures and infrastructure gaps remain challenges, advancements in vehicle technology and supportive government policies will continue to reshape the market. Commercial vehicles will remain essential to Australia’s economic productivity, sustainability goals, and long-term transport resilience.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar