-

Newsfeed

- ERKUNDEN

-

Seiten

-

Gruppen

-

Veranstaltungen

-

Reels

-

Blogs

-

Marktplatz

-

Jobs

Unlocking Success: The Best Indicator for Day Trading

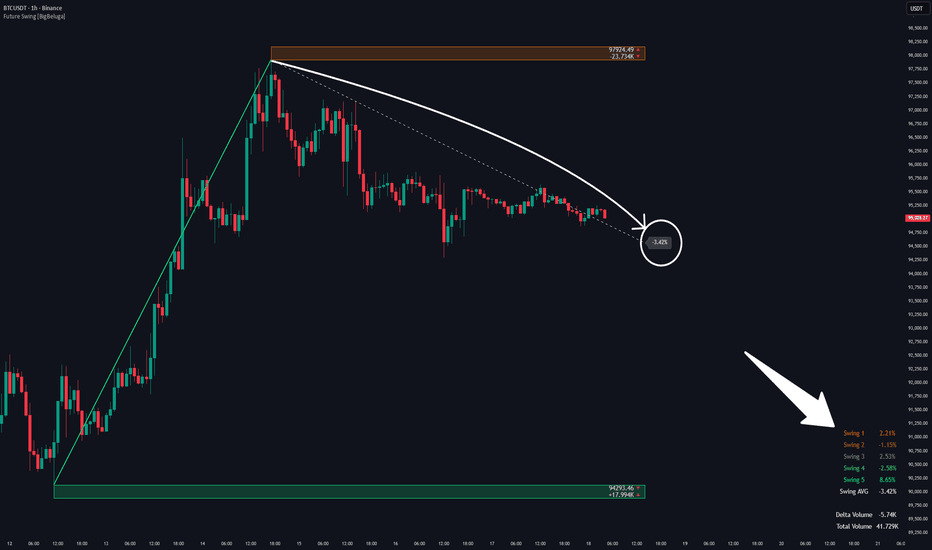

Day trading is not just about luck or intuition—it is a skill that requires precision, discipline, and the right tools. Among these tools, technical indicators stand out as essential for making informed trading decisions. Choosing the best indicator for day trading can make the difference between a profitable session and costly mistakes. Traders who master this art often report significantly higher risk-to-reward ratios, sometimes doubling or tripling their gains simply by entering trades at the right moment. One tool that has gained attention for this purpose is PipTrend, offering clear signals and high-probability setups that simplify market decision-making.

The financial markets are inherently volatile, and day traders face the challenge of reacting quickly to price movements. This is why having the best indicator for day trading is crucial. Indicators are mathematical calculations based on historical price and volume data. They help traders identify trends, reversals, and potential entry or exit points. Without an effective indicator, a trader may rely solely on guesswork, leading to emotional decisions and inconsistent results.

Among the most widely recognized indicators, moving averages are often considered foundational. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) help identify the general trend by smoothing out price fluctuations. By observing where the price is relative to the moving average, traders can decide whether to enter a trade in the direction of the trend. However, while moving averages are useful, they are not always the best indicator for day trading on their own—they work best when combined with momentum or volume-based indicators.

Another powerful tool is the Relative Strength Index (RSI). RSI measures the speed and change of price movements, highlighting overbought or oversold conditions. When an asset reaches extreme levels, traders often anticipate a reversal or a pullback. Using RSI in combination with trend analysis can give traders a clear view of market conditions and help identify high-probability setups. Incorporating such indicators can greatly enhance the accuracy of a trader’s strategy.

Bollinger Bands are another popular choice for day traders seeking precision. These bands create a dynamic range based on volatility, helping traders understand when prices are unusually high or low. A breakout above or below the bands can signal the start of a strong trend. Combining Bollinger Bands with other momentum indicators can create a comprehensive strategy, providing both entry and exit cues that improve the risk-to-reward ratio.

Despite the variety of indicators available, many professional traders emphasize that the best indicator for day trading is one that provides clear and actionable signals with minimal ambiguity. This is where tools like PipTrend excel. PipTrend is designed to highlight optimal entry points in real-time, reducing the guesswork and helping traders act decisively. By signaling high-probability setups, it allows traders to align their trades with the market’s momentum, increasing the likelihood of profitable outcomes.

It is also essential to understand that no single indicator works in isolation. The best indicator for day trading is often part of a larger strategy that includes risk management, market analysis, and psychological discipline. Traders who combine multiple indicators—trend-following tools, oscillators, and volume-based signals—often achieve a more balanced perspective on market conditions. This multi-layered approach helps avoid false signals and ensures that entries and exits are strategically timed.

Risk management remains a critical element in day trading success. Even the most effective indicator cannot guarantee profits on every trade. Setting stop-loss levels, defining position sizes, and maintaining a disciplined trading routine are key practices that complement any indicator. With the best indicator for day trading, traders can enter positions with confidence, knowing that their strategy is supported by reliable signals rather than speculation.

Finally, technology has transformed the way traders access and interpret indicators. Modern platforms now provide real-time alerts, backtesting features, and visual cues that simplify complex data analysis. PipTrend, for example, combines these features to create a user-friendly interface that enhances decision-making. Traders can see high-probability setups clearly, ensuring that they act swiftly when market conditions align with their strategy.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar