-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Reels

-

Blogs

-

Marketplace

-

Jobs

India Beauty & Personal Care Market 2026–2034: Products & States

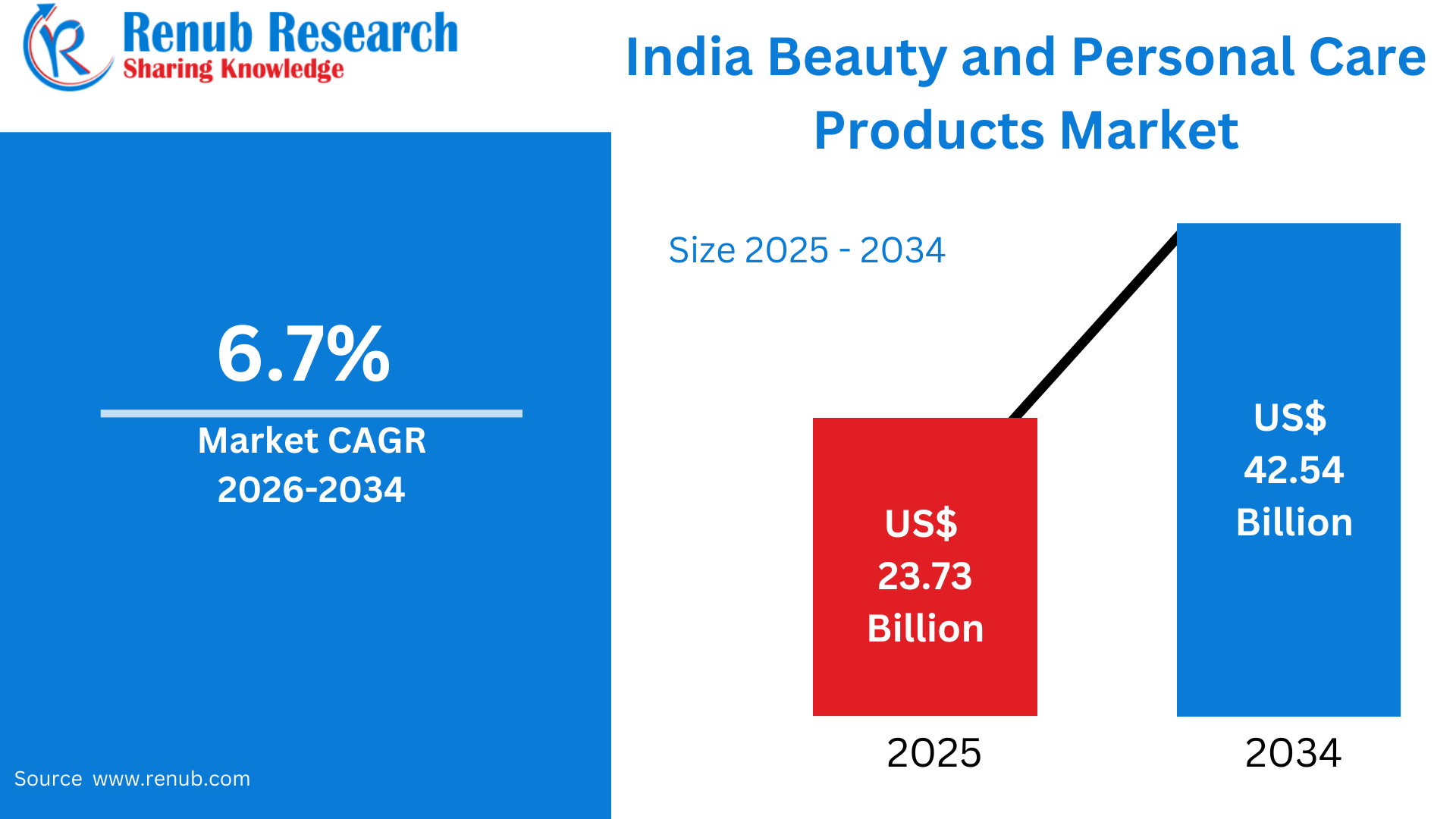

India Beauty and Personal Care Products Market Size and Forecast 2026–2034

According To Renub Research India beauty and personal care products market is witnessing consistent and long-term expansion, supported by rising consumer awareness, lifestyle changes, and increasing disposable incomes. The market is projected to grow from approximately US$ 23.73 billion in 2025 to around US$ 42.54 billion by 2034, registering a compound annual growth rate (CAGR) of about 6.7% during the period 2026–2034. This growth reflects the transformation of beauty and personal care from discretionary spending to a daily necessity across diverse demographic segments. Increasing urbanization, wellness consciousness, digital influence, and a strong preference for natural and herbal formulations are shaping the future of this market in India.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=india-beauty-personal-care-products-market-p.php

Indian Beauty and Personal Care Market Outlook

Beauty and personal care products include a wide range of cosmetic and hygiene items designed to cleanse, protect, nourish, and enhance the human body. These products encompass skin care, hair care, oral care, color cosmetics, fragrances, grooming products, and other personal hygiene items. Over time, beauty and personal care has evolved beyond basic hygiene to become an integral part of self-expression, confidence, and overall well-being.

In India, the demand for beauty and personal care products has accelerated significantly due to lifestyle upgrades, increasing spending capacity, and greater awareness of health and grooming. Consumers across age groups and genders now actively invest in personal care routines. The influence of social media, celebrity endorsements, digital advertising, and beauty influencers has reshaped consumer preferences and increased experimentation with new products. In parallel, India’s cultural inclination toward Ayurveda and natural remedies has strengthened demand for herbal, organic, and chemical-free products, blending tradition with modern consumer expectations.

Factors Contributing to the Growth of the India Beauty and Personal Care Market

Rising Disposable Income and Rapid Urbanization

Increasing disposable income and rapid urbanization are among the most influential growth drivers for India’s beauty and personal care products market. With urban areas expected to house over half of India’s population by 2050 and contribute a significant share of national GDP, exposure to modern lifestyles and global beauty trends continues to rise. Urban professionals place a strong emphasis on appearance, grooming, and wellness, driving higher spending on skin care, hair care, and premium personal care products.

This trend is no longer limited to metropolitan cities. Tier-2 and tier-3 cities are experiencing similar lifestyle aspirations, supported by rising incomes, improved retail infrastructure, and access to digital platforms. The expansion of shopping malls, organized retail chains, and exclusive beauty outlets has further improved product availability and brand visibility. As India’s middle class continues to expand, spending on beauty and personal care products is expected to rise steadily.

Growing Demand for Natural, Herbal, and Ayurvedic Products

India is witnessing a significant shift toward natural, herbal, and Ayurvedic beauty and personal care products. Consumers are increasingly concerned about the long-term effects of synthetic chemicals and are seeking safer, plant-based alternatives. The strong cultural foundation of Ayurveda and traditional wellness practices makes herbal products highly appealing and trustworthy.

Natural ingredients such as aloe vera, neem, turmeric, sandalwood, and essential oils are widely accepted across age groups. Consumers perceive these products as gentler, more effective, and better aligned with holistic health. This preference has encouraged both established players and new entrants to expand their portfolios of organic and Ayurvedic offerings, strengthening this segment as one of the fastest-growing areas of the Indian beauty and personal care market.

Digital Influence and Expansion of E-commerce

Digital platforms and e-commerce have become critical growth enablers for the Indian beauty and personal care market. Social media platforms, beauty tutorials, influencer marketing, and targeted online advertising strongly influence consumer purchasing decisions. E-commerce platforms provide access to a wide variety of domestic and international brands, supported by detailed product descriptions, reviews, and ratings.

Increasing smartphone penetration, particularly in smaller cities and rural areas, has expanded the online customer base. Direct-to-consumer models allow brands to engage more closely with consumers, introduce niche products, and offer personalized experiences. Digital channels have become especially important for new product launches, premium offerings, and emerging brands, making e-commerce a key driver of market expansion.

Challenges in the India Beauty and Personal Care Products Market

Intense Competition and Price Sensitivity

The Indian beauty and personal care market is highly competitive, with a large presence of domestic brands, multinational corporations, regional players, and unorganized manufacturers. Price sensitivity remains a significant challenge, especially in the mass market segment. Consumers often compare prices and switch brands based on discounts and promotional offers, putting pressure on profit margins.

New entrants face high marketing and distribution costs to establish brand visibility and trust. Differentiation based on formulation, performance, packaging, and branding has become increasingly difficult as competition intensifies. Sustaining margins while remaining affordable continues to be a critical challenge for market participants.

Regulatory Compliance and Product Safety Concerns

Regulatory compliance is another major challenge for beauty and personal care manufacturers in India. Products must adhere to strict regulations related to ingredient usage, labeling, formulation, and quality standards. Frequent updates in regulations increase compliance costs, particularly for small and medium-sized enterprises.

Issues such as counterfeit products, mislabeling, and inconsistent quality can negatively impact consumer trust. Ensuring product safety, authenticity, and consistent quality across extensive distribution networks remains essential for maintaining brand reputation and long-term growth.

Indian Organic Beauty and Personal Care Products Market

The organic beauty and personal care segment in India is expanding rapidly as consumers seek eco-friendly, chemical-free, and ethically sourced products. Awareness of the adverse effects of synthetic ingredients has increased demand for organic skin care, hair care, oral care, and hygiene products made from plant-based and Ayurvedic ingredients. This segment aligns closely with India’s traditional wellness values and appeals to health-conscious and environmentally aware consumers, positioning it as a high-growth niche within the broader market.

Indian Skin Care Products Market

Skin care is one of the fastest-growing categories within India’s beauty and personal care sector. Rising concerns about pollution, sun exposure, aging, and skin health have increased demand for moisturizers, cleansers, sunscreens, serums, and anti-aging products. Consumers are adopting multi-step skin care routines influenced by dermatologists and digital content.

Personalized skin care solutions, derma-tested products, and cosmeceuticals are gaining traction among both men and women. Lifestyle changes and climatic conditions further reinforce the importance of skin care, making it a core segment of market growth.

India Beauty and Personal Care Mass Products Market

Mass products dominate the Indian beauty and personal care market in terms of volume. Affordable products such as soaps, shampoos, hair oils, toothpaste, and basic grooming items are consumed daily by a large population base. Strong distribution networks, competitive pricing, and trusted brands ensure steady demand. Despite premiumization trends, mass products will continue to play a vital role due to India’s price-conscious consumer base.

India Beauty and Personal Care Specialty Stores Market

Specialty beauty and personal care stores are gaining importance in India by offering curated product selections and enhanced shopping experiences. These stores focus on skin care, cosmetics, fragrances, and premium personal care products while providing expert guidance and personalized assistance. Urban consumers increasingly prefer specialty stores for authentic products, professional advice, and access to premium brands, supporting the growth of this channel.

India Female Beauty and Personal Care Products Market

Women represent the largest and most influential consumer segment in India’s beauty and personal care market. Rising workforce participation, higher disposable incomes, and evolving perceptions of beauty have increased spending on grooming, skin care, cosmetics, and wellness products. Brands are introducing specialized products catering to different age groups, skin types, and life stages. Digital content, beauty tutorials, and social media trends further shape purchasing behavior, making female consumers a major driver of market growth.

Maharashtra Beauty and Personal Care Products Market

Maharashtra is one of the most developed and high-revenue markets for beauty and personal care products in India. Cities such as Mumbai, Pune, and Nagpur exhibit strong demand for skin care, hair care, cosmetics, fragrances, and grooming products. High disposable income, urban lifestyles, advanced retail infrastructure, and widespread e-commerce adoption support sustained growth. Consumers show a strong preference for high-quality, dermatologically tested, and natural products, reinforcing Maharashtra’s leadership position.

Uttar Pradesh Beauty and Personal Care Products Market

Uttar Pradesh is emerging as a high-volume, high-growth market due to its large population and increasing urbanization. Cities such as Noida, Ghaziabad, Lucknow, and Kanpur are witnessing rising demand for skin care, hair care, oral care, and grooming products. While mass products dominate due to affordability, demand for branded and herbal products is growing in urban and semi-urban areas. Improved retail infrastructure and e-commerce penetration continue to enhance market accessibility.

Telangana and Andhra Pradesh Beauty and Personal Care Products Market

The beauty and personal care market in Telangana and Andhra Pradesh is expanding due to rising awareness of grooming, hygiene, and wellness. Urban centers such as Hyderabad, Visakhapatnam, Vijayawada, and Tirupati are driving demand for skin care, hair care, and cosmetic products. A strong cultural preference for herbal and Ayurvedic solutions supports the growth of natural personal care products. Increasing digital influence and distribution reach further support market expansion.

Gujarat Beauty and Personal Care Products Market

Gujarat’s beauty and personal care market is driven by economic activity, value-conscious consumers, and a focus on quality and durability. Cities such as Ahmedabad, Surat, and Vadodara show consistent demand for skin care, hair care, and grooming products. While mass and mid-range products dominate, awareness of herbal and wellness-oriented offerings is increasing. Strong distribution networks and rising health awareness continue to support growth in the state.

Market Segmentation Overview

The India beauty and personal care products market is segmented by type into conventional and organic products. By product category, it includes skin care, hair care, color cosmetics, fragrances, and others. Pricing segments include mass products and premium products. Distribution channels comprise supermarkets and hypermarkets, specialty stores, e-commerce, and other retail formats. End users include male and female consumers. Key states driving demand include Maharashtra, Tamil Nadu, Karnataka, Gujarat, Uttar Pradesh, West Bengal, Rajasthan, Telangana, Andhra Pradesh, and Madhya Pradesh.

Competitive Landscape and Company Analysis

The competitive landscape includes major global and regional players involved in raw materials, formulations, and chemical inputs for beauty and personal care products. Key companies include BASF SE, China Petrochemical Corporation, Daelim Co. Ltd, Exxon Mobil Corporation, Formosa Plastics Corporation, HPCL-Mittal Energy Limited, INEOS, LG Chem Ltd., LyondellBasell Industries N.V., and Sumitomo Chemical Co. Ltd.. These companies support the industry through innovation, supply chain integration, and material advancements, shaping the future growth of India’s beauty and personal care products market.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar