India Perfume Market Report 2026–2034 by Product & End User

India Perfume Market Size and Forecast 2026–2034

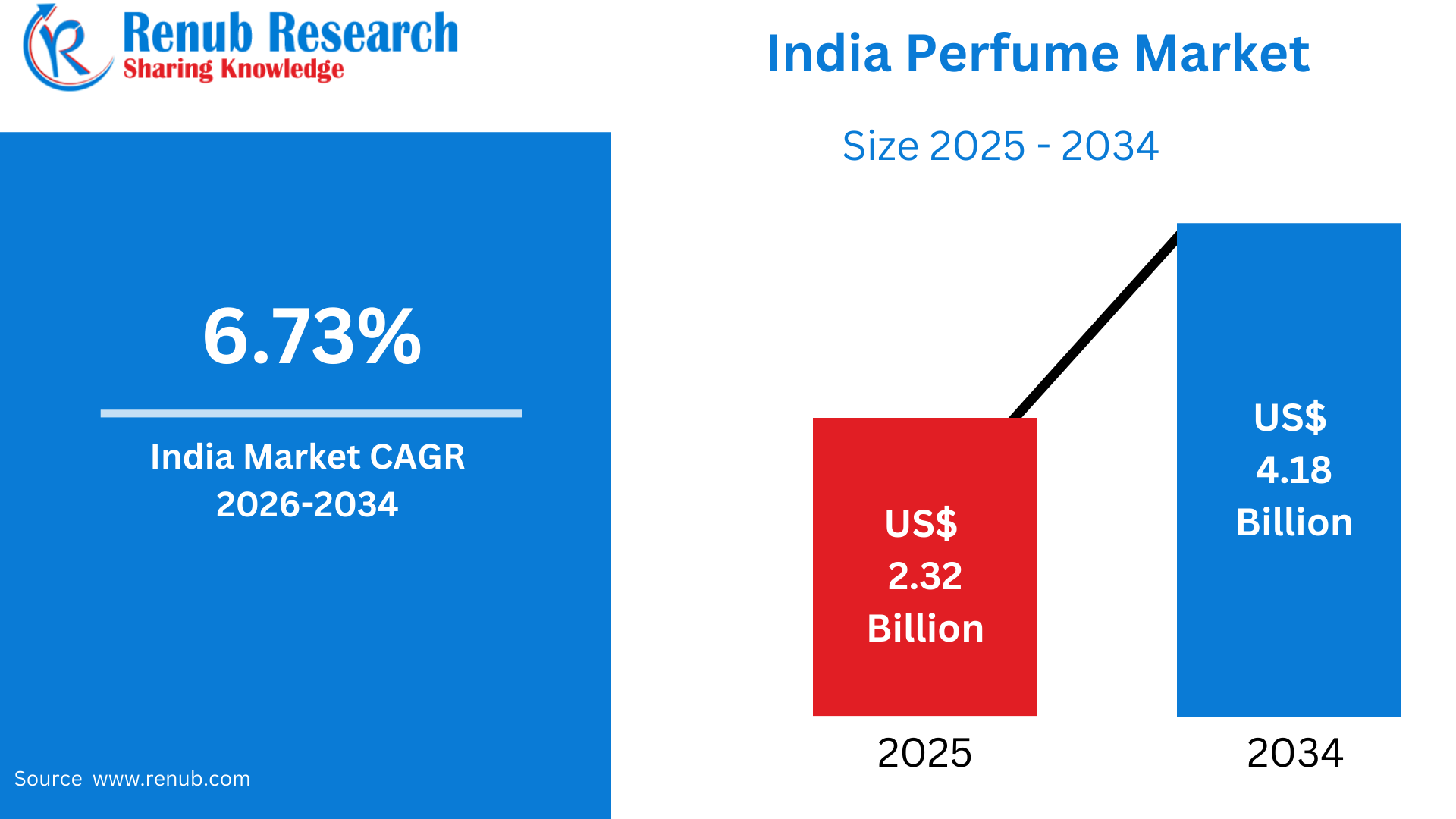

According To Renub Research India perfume market is set for steady and sustainable growth over the forecast period, expanding from a value of USD 2.32 billion in 2025 to approximately USD 4.18 billion by 2034. This growth reflects a compound annual growth rate (CAGR) of 6.73% during 2026–2034. The market’s expansion is supported by rising disposable incomes, a rapidly growing youth population, increasing urbanization, and a cultural shift toward personal grooming and lifestyle enhancement.

Perfume consumption in India is evolving from an occasional luxury purchase to a regular personal care habit. Organized retail expansion, strong digital influence, and the rapid growth of e-commerce platforms are making a wide range of fragrances accessible across urban and semi-urban regions. As consumers become more brand-aware and experimental, the perfume market is transitioning toward higher value, premiumization, and diversified product offerings.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=india-perfume-market-p.php

India Perfume Market Outlook

Perfume is a scented formulation made using aromatic compounds, essential oils, solvents, and fixatives to create a pleasant and lasting fragrance. Based on concentration levels, perfumes are classified into formats such as eau de parfum, eau de toilette, and eau de cologne, each offering different intensity and longevity. Fragrance families range from floral, woody, and oriental to fresh, aquatic, and spicy, catering to diverse consumer preferences and usage occasions.

In India, perfume usage is closely tied to lifestyle aspirations, hygiene awareness, and self-expression. Exposure to global beauty and grooming trends through social media, cinema, and influencer culture has significantly reshaped consumer behavior. Traditional Indian attars and natural fragrances coexist with modern western perfumery, creating a uniquely hybrid fragrance culture. Improved retail access and digital discovery have further accelerated adoption across demographics.

Rising Disposable Income and Aspirational Consumption

The rapid expansion of India’s middle class is one of the most important drivers of perfume market growth. Rising disposable incomes have enabled consumers to move beyond basic necessities and invest in lifestyle and grooming products. Perfumes are increasingly perceived as affordable indulgences and daily-use essentials, especially among urban and semi-urban consumers.

Aspirational consumption is further fueled by global exposure, premium branding, and celebrity endorsements. Young professionals and students view fragrances as an extension of their personality and social confidence. As per capita disposable income continues to rise, consumers are more willing to experiment with multiple fragrances for different occasions, boosting overall market value and frequency of purchase.

Influence of Youth Population and Digital Media

India’s demographic advantage plays a crucial role in shaping the perfume market. A large proportion of the population is under 35 years of age, making the market highly responsive to digital trends and influencer-driven marketing. Social media platforms promote concepts such as signature scents, fragrance layering, and mood-based perfume usage, encouraging frequent experimentation.

Digital-first fragrance brands, limited-edition launches, and celebrity-backed perfumes generate strong engagement and urgency among young buyers. Online reviews, short-form videos, and influencer collaborations rapidly shape brand perception and buying decisions. Youth consumers typically prefer trendy, affordable, and long-lasting fragrances, supporting high product turnover in the mass and mid-range segments.

Product Innovation and Cultural Customization

Innovation and localization are key differentiators in the Indian perfume market. Brands are increasingly designing fragrances that suit Indian climate conditions, cultural preferences, and longevity expectations. Long-lasting formulations, alcohol-free attars, and hybrid blends combining oriental depth with western freshness are gaining popularity.

Packaging innovation has also improved accessibility, with roll-ons, pocket sprays, and travel-size bottles encouraging impulse purchases and trial usage. Indian botanical ingredients such as sandalwood, jasmine, rose, and vetiver add authenticity and appeal. Seasonal launches aligned with festivals and gifting traditions further stimulate cyclical demand. Customization, gender-neutral fragrances, and wellness-inspired scents are accelerating product differentiation across price segments.

Challenges in the India Perfume Market

Price Sensitivity and Counterfeit Products

Despite growing demand, India remains a highly price-sensitive market. Many consumers prioritize affordability, limiting penetration of premium brands beyond major urban centers. This environment has enabled the proliferation of counterfeit and grey-market products that mimic established brands at significantly lower prices.

Counterfeit perfumes erode consumer trust, damage brand equity, and distort pricing structures. Low switching costs and weak brand loyalty in mass segments further intensify competition. For genuine brands, balancing quality, authenticity, and affordability remains a persistent challenge, particularly in unorganized retail channels.

Distribution Gaps and Regulatory Complexities

While organized retail has expanded rapidly in metropolitan and Tier I cities, rural and semi-urban areas still face distribution limitations. Fragmented supply chains, logistics costs, and reliance on informal retail restrict deeper penetration. Regulatory requirements related to ingredient safety, labeling, and import duties add complexity, especially for international brands.

High import tariffs raise retail prices, impacting competitiveness, while regulatory approvals can delay product launches. Smaller players often struggle with compliance costs, slowing innovation and market expansion. Addressing these structural barriers is essential for achieving uniform growth across regions.

India Mass Perfume Market

The mass perfume segment accounts for the largest share of fragrance consumption in India due to affordability and widespread availability. Products in this category are designed for daily use and primarily target students, first-time users, and price-conscious consumers. Local and regional brands dominate, offering deodorants, body sprays, and simple fragrance blends with moderate longevity.

Distribution through kirana stores, pharmacies, and convenience outlets ensures high volume sales, particularly during festivals and promotional periods. Although margins are relatively thin, the scale of consumption makes the mass segment commercially significant and a key driver of overall market volume growth.

India Premium Perfume Market

The premium perfume segment in India is witnessing strong momentum driven by urban affluence, lifestyle upgrades, and gifting culture. Premium fragrances are increasingly seen as symbols of sophistication and self-expression rather than occasional luxuries. International luxury brands and niche artisanal labels are expanding their presence through malls, airports, and premium online platforms.

Consumers in this segment seek uniqueness, long-lasting performance, and high-quality ingredients. Corporate gifting, weddings, and festive occasions generate consistent demand spikes. While premium perfumes represent a smaller share in volume terms, they contribute disproportionately to market value growth, reinforcing the premiumization trend.

India Women Perfume Market

Women’s perfumes represent one of the fastest-growing categories in India, supported by rising workforce participation, fashion awareness, and self-care priorities. Urban women increasingly incorporate perfumes into daily grooming routines. Floral, fruity, and oriental fragrances remain popular, alongside growing experimentation with bold and unisex scents.

Marketing strategies focused on empowerment, elegance, and individuality resonate strongly with female consumers. Increased disposable income among working women supports higher spending on mid-range and premium fragrances, ensuring sustained category expansion.

India Men Perfume Market

The men’s perfume segment remains the largest gender-based category in India. Fragrance usage among men has evolved from occasional deodorant use to regular perfume application, especially in professional and urban environments. Woody, musky, aquatic, and spicy notes dominate preferences.

Youth-centric branding, celebrity endorsements, and workplace grooming culture drive repeat purchases. Men also account for a high proportion of impulse buying, supporting volume stability across mass and premium segments. This segment continues to be a critical revenue pillar for the Indian perfume industry.

India Offline Perfume Market

Offline retail continues to dominate perfume sales in India due to the sensory nature of fragrance purchasing. Consumers prefer to test fragrances before buying, especially in premium and gifting segments. Department stores, malls, specialty cosmetic outlets, and duty-free shops play a key role in brand experience and customer acquisition.

Trained staff, testers, and in-store promotions enhance consumer confidence. Offline retail remains particularly important in Tier II and Tier III cities, where trust in online fragrance purchases is still developing. Seasonal shopping peaks during festivals and weddings further strengthen offline sales.

Regional Insights Across Indian States

Maharashtra leads the Indian perfume market, driven by urban density, high income diversity, and strong lifestyle influence from cities like Mumbai and Pune. Uttar Pradesh contributes significantly in volume terms due to its large population and dominance of mass and mid-priced fragrances.

Karnataka, particularly Bengaluru, shows strong demand for premium and niche fragrances due to its young professional population and global exposure. West Bengal reflects a blend of traditional fragrance preferences and modern grooming habits, while Andhra Pradesh demonstrates steady growth supported by urbanization and lifestyle spending. Regional diversity highlights the importance of localized strategies for brands operating nationwide.

Market Segmentation Overview

The India perfume market is segmented by product type into mass and premium categories. End users include men, women, and unisex consumers, reflecting evolving preferences for gender-neutral fragrances. Distribution channels are divided into offline and online platforms, with offline retaining dominance and online growing rapidly.

Geographically, key contributing states include Maharashtra, Tamil Nadu, Karnataka, Gujarat, Uttar Pradesh, West Bengal, Telangana, and Andhra Pradesh, among others, each offering distinct demand patterns and growth opportunities.

Competitive Landscape and Company Analysis

The Indian perfume market features a mix of global fragrance leaders and established domestic players. Major companies shaping the competitive environment include The Avon Company, CHANEL, Coty Inc., LVMH Moët Hennessy – Louis Vuitton, Estée Lauder Companies, Revlon, Puig, L'Oréal Groupe, Shiseido Company, Limited, and Givaudan.

These companies compete through brand strength, innovation, localized product launches, and omnichannel distribution strategies. Detailed analysis typically includes overviews, leadership insights, recent developments, SWOT assessments, and revenue analysis to evaluate long-term positioning.

Conclusion

The India perfume market is on a strong growth trajectory, supported by favorable demographics, rising incomes, digital influence, and evolving grooming habits. While challenges such as price sensitivity, counterfeit products, and distribution gaps persist, ongoing innovation, premiumization, and expanding retail access continue to reshape the industry.

As perfumes increasingly become a part of daily lifestyle and self-expression, India is poised to remain one of the most attractive emerging markets for fragrance manufacturers during the 2026–2034 forecast period.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar