-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Reels

-

Статьи пользователей

-

Маркет

-

Jobs

United States Gluten-Free Baking Mixes Market Analysis 2026–2034

United States Gluten-free Baking Mixes Market Size and Forecast (2026–2034)

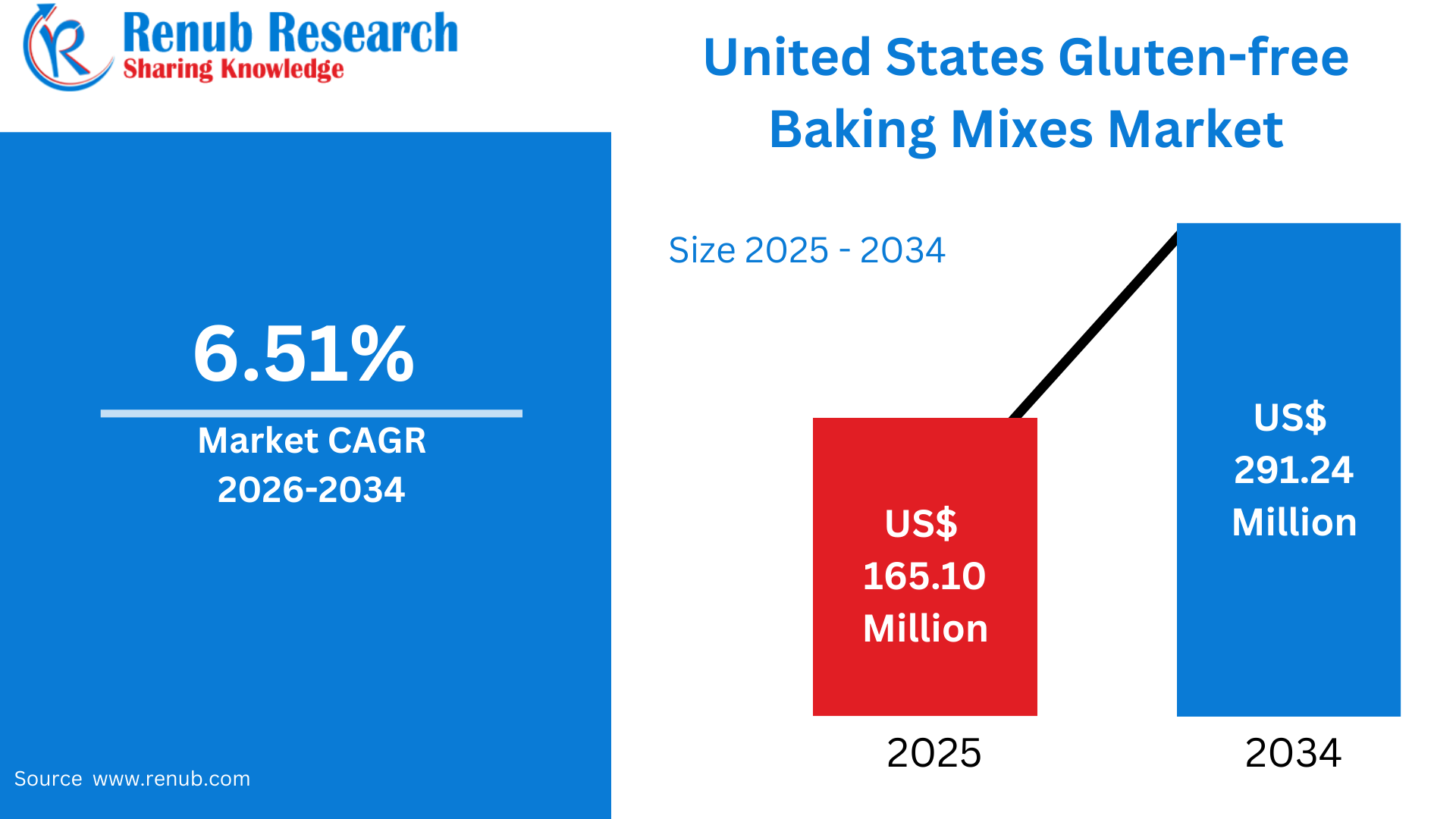

According To Renub Research United States gluten-free baking mixes market is poised for steady and resilient growth over the forecast period, reflecting evolving dietary preferences, rising health awareness, and a strong culture of home baking. The market is projected to expand from US$ 165.10 million in 2025 to US$ 291.24 million by 2034, registering a compound annual growth rate (CAGR) of 6.51% from 2026 to 2034. This growth trajectory highlights how gluten-free baking mixes have transitioned from a niche, medically driven category to a mainstream, lifestyle-oriented segment within the broader packaged food industry.

Increasing awareness of celiac disease, gluten intolerance, and digestive wellness is a fundamental driver of this expansion. At the same time, demand is being reinforced by clean-label food trends, the desire for ingredient transparency, and the growing popularity of convenient home-baking solutions. Improvements in flour blends, texture-enhancing technologies, and wider availability across retail and online platforms are further strengthening the market’s long-term outlook across the United States.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-gluten-free-baking-mixes-market-p.php

United States Gluten-free Baking Mixes Market Outlook

Gluten-free baking mixes are pre-formulated, ready-to-use blends designed to replace conventional wheat-based baking mixes while eliminating gluten. These mixes are typically made using alternative flours and starches such as rice flour, corn flour, almond flour, tapioca starch, potato starch, sorghum, and various binding agents. They are used to prepare a wide range of baked goods, including bread, cakes, cookies, muffins, pancakes, brownies, and pizza crusts.

The primary value proposition of gluten-free baking mixes lies in convenience and consistency. Gluten-free baking from scratch can be technically challenging due to the absence of gluten, which normally provides elasticity and structure. Baking mixes simplify this process by delivering reliable texture, flavor, and baking performance without requiring consumers to measure and combine multiple specialty ingredients. In the United States, these products have gained broad acceptance due to improved taste profiles, enhanced nutritional value, and widespread availability in supermarkets, health food stores, and digital channels.

Growth Drivers of the United States Gluten-free Baking Mixes Market

Rising Prevalence of Gluten Intolerance and Health Awareness

A key driver of market growth is the increasing diagnosis of celiac disease, non-celiac gluten sensitivity, and other digestive disorders. While celiac disease affects a relatively small percentage of the population, a much larger group of consumers voluntarily avoids gluten as part of broader wellness and clean-eating practices. Gluten-free foods are often associated with improved digestion, reduced inflammation, and healthier lifestyles, particularly among health-conscious households.

Home baking plays a critical role in this trend, as consumers prefer greater control over ingredients, allergens, sugar content, and portion sizes. As awareness continues to spread through medical guidance, food labeling, and nutrition education, gluten-free baking mixes are becoming a normalized pantry staple rather than a specialized dietary product.

Home Baking Culture and Lifestyle Shifts

The sustained popularity of home baking is another major growth catalyst for gluten-free baking mixes. Baking has evolved into a lifestyle activity associated with comfort, creativity, and family bonding. Gluten-free mixes appeal strongly to busy households, working professionals, and families with dietary restrictions, as they reduce preparation time while delivering consistent results.

Seasonal demand during holidays, celebrations, and family gatherings further boosts sales volumes. Parents of children with food allergies increasingly rely on gluten-free mixes to prepare safe snacks and desserts. Innovations such as functional ingredients, collagen infusion, and nutrient fortification are also expanding the appeal of these products beyond traditional dietary users.

Product Innovation and Premiumization

Ongoing product innovation is reshaping the competitive landscape of the gluten-free baking mixes market. Manufacturers are focusing on improving flavor, texture, moisture retention, and nutritional density to match or exceed traditional wheat-based products. This includes the use of ancient grains, high-protein blends, organic ingredients, low-sugar formulations, and allergen-free recipes.

Premiumization has emerged as a strong trend, with products positioned around non-GMO, vegan, clean-label, and functional nutrition claims. Packaging innovations, such as single-serve packs and family-size options, are expanding usage occasions. Specialized mixes for bread, pizza crusts, pancakes, brownies, and cakes are encouraging repeat purchases and deeper category engagement among consumers.

Challenges in the United States Gluten-free Baking Mixes Market

Higher Prices and Cost Sensitivity

Despite growing demand, higher pricing remains a structural challenge for gluten-free baking mixes. Specialty raw materials, dedicated gluten-free manufacturing facilities, certification processes, and stringent quality controls significantly increase production costs. As a result, gluten-free mixes are often priced well above conventional alternatives.

Price sensitivity is particularly evident among middle- and lower-income households, where gluten-free purchases are often limited to medical necessity rather than lifestyle choice. Economic uncertainty further amplifies value-oriented purchasing behavior. Although private-label offerings are helping to narrow the price gap, cost remains a barrier to mass-market penetration and repeat consumption.

Texture, Taste, and Shelf-life Limitations

While formulation technology has advanced significantly, replicating the elasticity, softness, and moisture retention of gluten-containing baked goods remains a technical challenge. Gluten-free products can suffer from crumbly textures, dryness, or reduced flavor complexity, which can negatively impact first-time user experiences.

Shelf-life limitations also pose challenges, as gluten-free baked goods may stale faster due to the absence of gluten’s natural binding properties. Manufacturers must balance clean-label demands with the need for stabilizers and functional additives, often at higher costs. These limitations can affect brand loyalty and slow adoption among mainstream consumers who prioritize taste and texture.

United States Gluten-free Bread Market

Gluten-free bread represents the largest and most critical segment within the gluten-free baking ecosystem. Bread is a daily dietary staple, making reliable gluten-free alternatives essential for both medically restricted and lifestyle-driven consumers. Demand spans packaged loaves, artisan-style breads, and home-baked products made using gluten-free baking mixes.

Consumers increasingly seek softer textures, longer freshness, and enhanced nutritional profiles, including added fiber, protein, and probiotics. Although gluten-free bread remains technically challenging to perfect, continuous innovation and growing consumer trust are supporting steady volume growth in this core segment.

United States Gluten-free Cookies and Biscuits Market

The gluten-free cookies and biscuits segment benefits from strong snacking culture and indulgence-driven consumption. Cookies are more forgiving in gluten-free formulations, allowing manufacturers to achieve better taste and texture consistency compared to bread. This has helped gluten-free cookies gain acceptance even among consumers without gluten intolerance.

Home-baking mixes enable customization of sweetness, fat content, and ingredient quality, appealing to parents and health-conscious snackers. Seasonal flavors, premium inclusions, and gifting demand during holidays further drive growth, making this one of the fastest-expanding categories within the market.

United States Gluten-free Corn Flour Baking Mixes Market

Corn flour baking mixes form a foundational segment due to corn’s natural gluten-free properties and widespread consumer familiarity. These mixes are widely used for cornbread, muffins, tortillas, pancakes, and regional baked goods. Corn flour is relatively cost-efficient compared to nut-based flours, making it attractive to value-oriented consumers.

Strong cultural acceptance in traditional American and Hispanic cuisines supports consistent demand. While corn-based products can be dense or dry if poorly formulated, ongoing improvements in blending techniques are enhancing texture and overall appeal.

United States Gluten-free Rice Flour Baking Mixes Market

Rice flour baking mixes are favored for premium and versatile formulations due to their neutral flavor, fine texture, and high digestibility. These mixes are used across a wide range of sweet and savory applications, including cakes, cookies, bread, and multi-purpose blends.

Rice flour absorbs flavors effectively, making it suitable for diverse recipes. Although it often requires additional starches and gums for structure, its predictability makes it popular among first-time gluten-free bakers. Growing demand for hypoallergenic ingredients further supports steady growth in this segment.

Distribution Channel Analysis in the United States

Online retail is the fastest-growing distribution channel for gluten-free baking mixes, offering extensive product variety, ingredient transparency, and access to specialty formulations. Subscription models, direct-to-consumer platforms, and digital communities enhance repeat purchases and brand engagement.

Supermarkets, hypermarkets, and specialist health stores remain critical for visibility and impulse buying, while convenience stores are gradually expanding their role through single-serve and trial-focused offerings. Omnichannel strategies are increasingly important in strengthening consumer reach and loyalty.

Regional Market Outlook Across Key States

California leads the national market due to its health-conscious population, high disposable incomes, and strong food innovation ecosystem. New York represents a high-value, urban-driven market with strong demand for premium and artisanal gluten-free products. Texas offers volume-driven growth potential, supported by a large population base and expanding retail infrastructure, though price sensitivity remains higher.

Arizona demonstrates consistent growth driven by wellness-oriented demographics and expanding digital access, while other states continue to show gradual adoption as awareness and distribution improve nationwide.

Market Segmentation Overview

The United States gluten-free baking mixes market is segmented by product type into bread, cookies and biscuits, cakes and muffins, and other bakery products. By flour type, the market includes corn flour, rice flour, and other specialty blends. Distribution channels span supermarkets, convenience stores, specialist retailers, online platforms, and alternative channels. State-level segmentation highlights strong demand across both mature and emerging regional markets.

Competitive Landscape and Company Analysis

The competitive landscape includes established food companies and specialized gluten-free brands such as General Mills Inc., Conagra Brands, Inc., Kinnikinnick Foods Inc., Williams-Sonoma Inc., Continental Mills, Inc., Partake Foods, Chebe, Naturpro, King Arthur Baking Company, Inc., and SalDoce Fine Foods.

Each company is assessed across multiple viewpoints, including business overview, leadership, recent developments, SWOT analysis, and revenue performance.

Outlook for the United States Gluten-free Baking Mixes Market

The United States gluten-free baking mixes market is expected to maintain steady growth through 2034, supported by health awareness, evolving consumer lifestyles, and continuous product innovation. While pricing and technical challenges persist, advancements in formulation, expanded retail access, and premium positioning are strengthening consumer confidence. As gluten-free eating becomes increasingly mainstream, baking mixes will remain a vital component of the U.S. specialty food landscape, balancing convenience, nutrition, and taste for a diverse consumer base.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar