-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Reels

-

Blogs

-

Marketplace

-

Jobs

Frozen Vegetables Market: Company Profiles, Strategy, Innovations & Forecasts

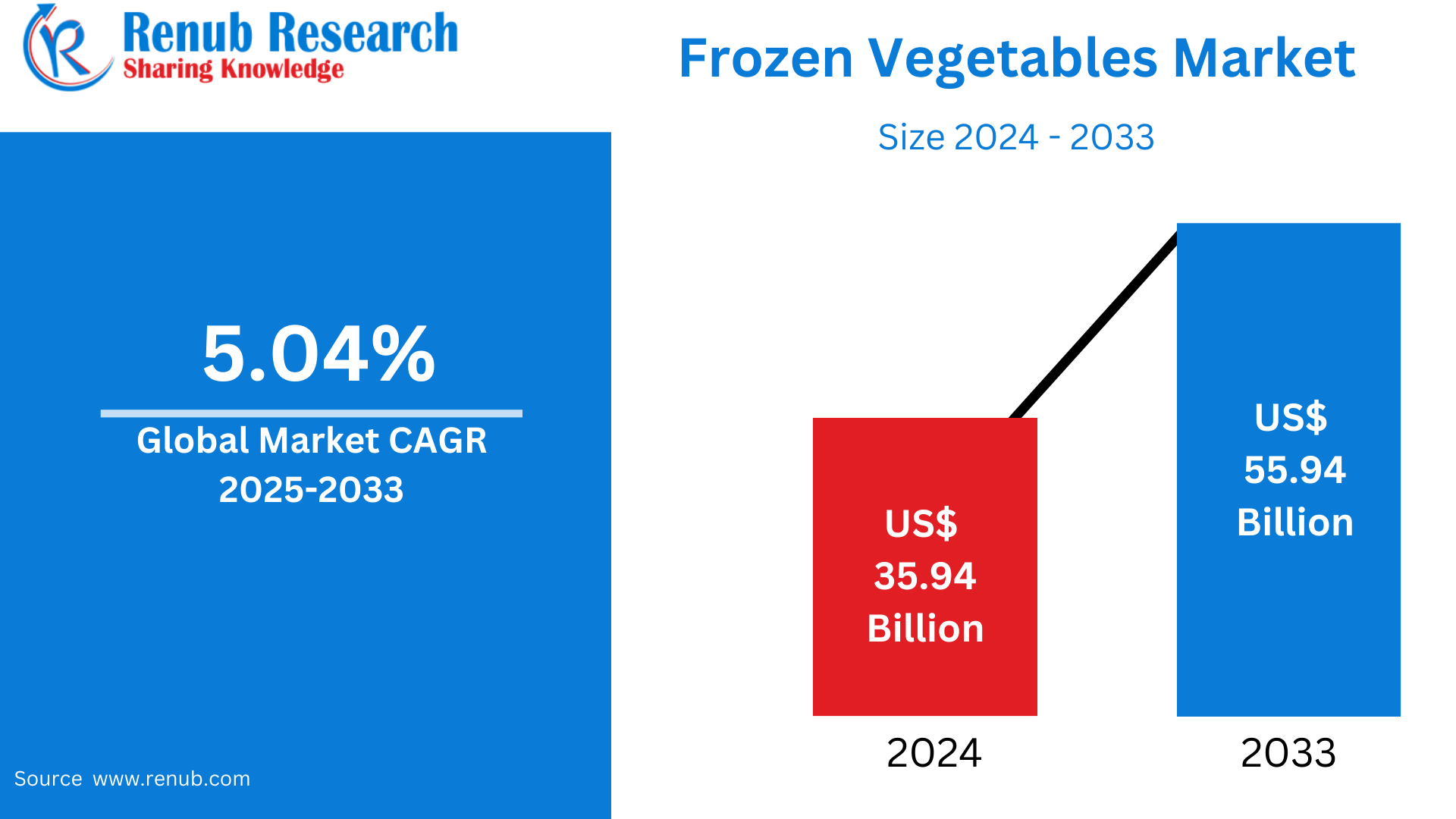

Frozen Vegetables Market Size & Forecast 2025–2033

According to Renub Research, the global frozen vegetables market reached a valuation of US$ 35.94 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 5.04% between 2025 and 2033. By the end of the forecast period in 2033, the market is expected to attain a value of US$ 55.94 billion. This steady expansion is primarily driven by rising consumer demand for convenient, nutritious, and long-lasting food products that align with modern urban lifestyles. Increasing adoption of ready-to-cook meals, combined with the year-round availability of high-quality frozen produce, continues to support market growth across both developed and emerging economies.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=frozen-vegetables-market-company-analysis-p.php

Frozen Vegetables Market Overview

Frozen vegetables are processed food products that are cleaned, trimmed, cut, and rapidly frozen shortly after harvesting using advanced flash-freezing technology. This process preserves freshness, flavor, texture, and nutritional value while significantly extending shelf life without the need for chemical preservatives. Frozen vegetables are available in multiple formats, including whole, chopped, mixed, seasoned, and value-added blends, offering consumers versatile and ready-to-use meal solutions.

Globally, frozen vegetables have gained widespread popularity due to their convenience, affordability, and consistent quality regardless of seasonality. With increasing urbanization, dual-income households, and time-constrained lifestyles, consumers are actively seeking healthy food options that require minimal preparation time. Frozen vegetables meet this demand by providing nutritionally dense ingredients with reduced food waste and easy portion control. Advances in cold storage infrastructure, packaging technology, and retail distribution channels have further enhanced product accessibility, making frozen vegetables a staple in households, foodservice operations, and institutional kitchens worldwide.

Key Growth Drivers in the Frozen Vegetables Market

Rising Demand for Convenience and Ready-to-Cook Foods

One of the primary growth drivers of the frozen vegetables market is the increasing demand for convenient food options. Consumers with busy lifestyles prefer products that reduce preparation time while maintaining nutritional value. Frozen vegetables are widely used in home cooking, quick meals, ready meals, soups, stir-fries, and foodservice applications, making them an essential component of modern diets.

Growing Focus on Nutrition and Healthy Eating

Consumers are becoming more health-conscious and are increasingly shifting toward diets rich in vegetables, fiber, vitamins, and minerals. Frozen vegetables retain most of their nutritional content due to rapid freezing shortly after harvest, often making them nutritionally comparable—or even superior—to fresh produce that undergoes long transportation and storage. This perception has strengthened demand among health-oriented consumers.

Reduction of Food Waste and Improved Shelf Life

Frozen vegetables contribute significantly to food waste reduction by offering longer shelf life and better portion control. This aligns well with global sustainability goals and consumer awareness regarding responsible consumption. Retailers and foodservice operators also benefit from reduced spoilage and inventory losses.

Expansion of Cold Chain and Retail Infrastructure

Ongoing investments in cold storage, refrigerated transportation, and modern retail formats have expanded the reach of frozen vegetables across urban and semi-urban regions. E-commerce grocery platforms and modern supermarkets have further accelerated market penetration, particularly in developing countries.

Top Manufacturers in the Frozen Vegetables Market

General Mills Inc

Founded in 1928 and headquartered in the United States, General Mills Inc is a global manufacturer and marketer of branded consumer foods. The company’s extensive portfolio includes frozen vegetables, frozen meals, snacks, cereals, baking products, and pet food. Its frozen food offerings are distributed across grocery stores, mass merchandisers, foodservice channels, and e-commerce platforms worldwide. General Mills operates across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

Conagra Brands

Established in 1919 and headquartered in the United States, Conagra Brands Inc is a major player in frozen and packaged foods. The company markets frozen vegetable products under well-known brands such as Birds Eye and Healthy Choice. Its strong retail presence, broad distribution network, and focus on value-added frozen meals make it a key contributor to the global frozen vegetables market.

Hormel Foods

Founded in 1891, Hormel Foods Corp is a diversified food manufacturer with a strong presence in frozen and refrigerated food categories. The company operates globally and markets a wide range of frozen vegetable-based meal solutions, catering to both retail and foodservice customers.

Unilever PLC

Unilever PLC, founded in 1929 and headquartered in the United Kingdom, is a leading fast-moving consumer goods company. Through brands such as Knorr, the company offers frozen and processed vegetable products across global markets. Its strong focus on sustainability and plant-based nutrition supports long-term growth in the frozen vegetables segment.

The Kraft Heinz Company

Founded in 1869, The Kraft Heinz Company is a global food and beverage manufacturer offering frozen vegetables under brands such as Ore-Ida. The company serves retail, foodservice, and institutional customers across multiple regions.

Product Launches in the Frozen Vegetables Market

McCain Foods Limited

In October 2023, McCain Foods USA partnered with The Culinary Edge to launch a new line of plant-based vegetable appetizers called V’DGZ. The product line targets health-oriented flexitarian consumers and reflects rising demand for innovative, vegetable-based frozen snacks.

Ardo Group

In April 2022, Ardo Group expanded its fresh-frozen herb portfolio by introducing new and enhanced herb mixes, including Italian, Mexican, Asian, and Thai-style blends. These launches strengthened Ardo’s position in value-added frozen vegetable products.

SWOT Analysis of Key Companies

Greenyard – Strengths

Greenyard benefits from a fully integrated supply chain and strong partnerships with growers, ensuring year-round availability of high-quality raw materials. Its advanced freezing technology, sustainability initiatives, and diversified frozen vegetable portfolio strengthen its competitive position across retail and foodservice markets.

Bonduelle Group – Strengths

Bonduelle Group’s key strengths include global brand recognition, decades of expertise in vegetable processing, and strong sustainability practices. The company offers a wide range of frozen vegetables, organic options, and ready-to-cook solutions supported by a strong international distribution network.

Recent Developments in the Frozen Vegetables Market

Nomad Foods Ltd

In September 2025, Nomad Foods announced a multi-year efficiency program targeting €200 million in savings through procurement transformation, manufacturing optimization, and logistics improvements. These savings are being reinvested into product innovation and digital marketing initiatives.

B&G Foods

In October 2025, B&G Foods signed an agreement to sell its Green Giant and Le Sieur frozen vegetable product lines in Canada to Nortera Foods, reflecting strategic portfolio realignment.

Sustainability Initiatives in the Frozen Vegetables Market

Findus Group

Findus Group emphasizes responsible sourcing, reduced carbon emissions, and sustainable farming practices. The company focuses on renewable energy adoption, waste reduction, and environmentally friendly packaging while promoting healthy eating habits among consumers.

Pinguin N.V.

Pinguin N.V., part of Greenyard, prioritizes sustainable agriculture, efficient resource usage, and circular production models. Its initiatives include precision farming, waste reuse, energy-efficient freezing systems, and improved packaging recyclability.

Frozen Vegetables Market Segmentation

Market Segmentation Overview

The frozen vegetables market is analyzed based on historical trends, forecast analysis, and market share evaluation across multiple segments.

Segmentation by Product Type

Single vegetables, mixed vegetables, seasoned vegetables, and value-added vegetable products.

Segmentation by Distribution Channel

Supermarkets and hypermarkets, convenience stores, online retail, foodservice, and institutional buyers.

Competitive Landscape and Company Coverage

The market report provides in-depth analysis for major players, including company overview, leadership structure, recent developments, sustainability strategies, product benchmarking, SWOT analysis, and revenue performance.

Covered companies include General Mills Inc, Conagra Brands, Hormel Foods, Unilever PLC, The Kraft Heinz Company, Nomad Foods Ltd, B&G Foods Inc, Greenyard, Bonduelle Group, McCain Foods Limited, Ardo Group, Findus Group, Pinguin N.V., Goya Foods Inc, Virto Group, Frosta AG, Aryzta AG, and Amy’s Kitchen Inc.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar