-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Reels

-

Blogs

-

Marketplace

-

Jobs

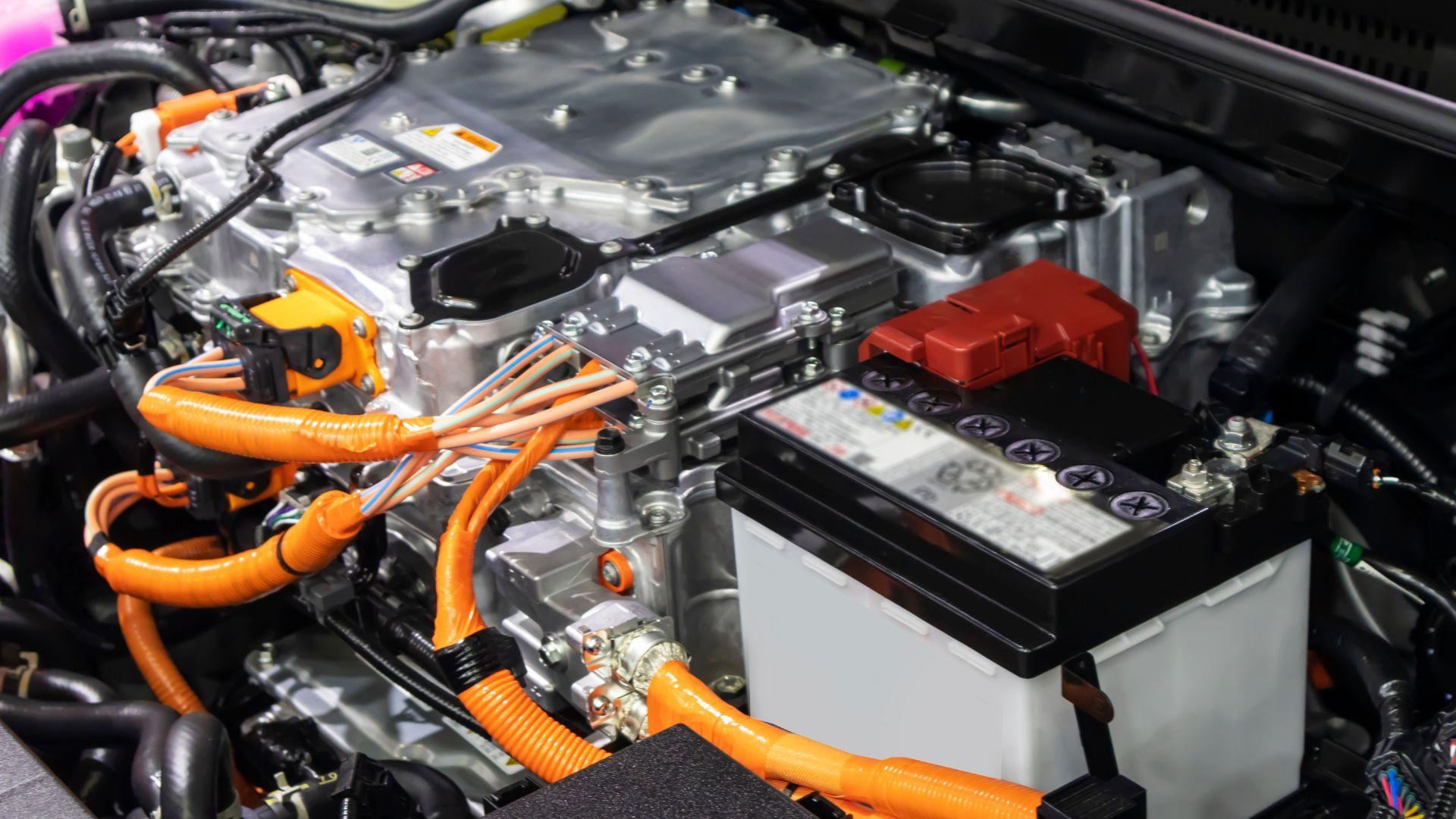

Reliable Power for a Changing Road: Lead-Acid Batteries Hold Ground 2033

Automotive Lead-Acid Battery Market Size and Forecast 2025–2033

The Automotive Lead-Acid Battery Market is projected to grow from US$ 12.54 billion in 2024 to approximately US$ 15.90 billion by 2033, reflecting a compound annual growth rate (CAGR) of 2.67% between 2025 and 2033. While the rise of lithium-ion technologies and full electric mobility is reshaping the automotive landscape, lead-acid batteries continue to play a critical and irreplaceable role in global vehicle systems.

This steady growth trajectory reflects expanding automotive fleets, increasing demand for cost-efficient energy storage, and continued reliance on starting, lighting, and ignition (SLI) systems worldwide.

Global Outlook on Automotive Lead-Acid Batteries

An automotive lead-acid battery is a rechargeable energy storage device primarily used to start internal combustion engines. It consists of lead dioxide (PbO₂) as the positive plate, sponge lead (Pb) as the negative plate, and sulfuric acid as the electrolyte.

For more than a century, lead-acid batteries have remained the standard power source for cars, trucks, and motorcycles. Their dominance stems from three major strengths:

· High surge current for engine ignition

· Cost efficiency compared to alternative chemistries

· Established recycling infrastructure

Even in hybrid and electric vehicles, lead-acid batteries are commonly used for auxiliary systems, including lighting, infotainment, and safety electronics. This continued integration ensures their relevance despite rapid electrification trends.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=automotive-lead-acid-battery-market-p.php

Growth Drivers in the Global Automotive Lead-Acid Battery Market

Rising Vehicle Production and Expanding Automotive Fleet

Global vehicle production and ownership continue to expand, particularly in emerging markets across Asia-Pacific, Latin America, and Africa. As vehicle fleets grow, so does demand for reliable SLI batteries.

Lead-acid batteries are favored by automakers due to their affordability, durability, and recyclability. Additionally, their typical three-to-five-year replacement cycle drives strong aftermarket demand.

In June 2025, the NAFA Fleet Management Association introduced the Sustainable Fleet Automotive Fleet Guidebook, providing fleet operators with guidance on sustainability, efficiency, and vehicle selection—further reinforcing structured fleet battery management practices.

Cost Efficiency and Proven Reliability

Lead-acid batteries maintain their market leadership due to their mature and predictable technology. Compared to lithium-ion batteries, they offer:

· Lower upfront cost

· Safe and stable performance

· Robust recycling systems

Manufacturers are enhancing battery performance through improved plate technology and electrolyte management systems. Innovations such as AGM (Absorbent Glass Mat) and EFB (Enhanced Flooded Battery) designs support start-stop systems and modern fuel-efficiency requirements.

In January 2024, India-based IPower Batteries launched a graphene-enhanced lead-acid battery series, certified by the International Centre for Automotive Technology (ICAT), demonstrating continued innovation in this traditional segment.

Strong Aftermarket Replacement Demand

The aftermarket remains a key revenue engine. Battery degradation due to temperature extremes, short trips, and heavy electronic loads ensures recurring replacement cycles.

Markets such as North America and Europe, where vehicle fleets are aging, show particularly strong replacement demand. The expansion of independent service chains and online automotive platforms has further improved accessibility and pricing transparency.

In July 2025, SEG Automotive expanded its product portfolio by introducing 12V POWERbattery solutions for cars, commercial vehicles, and transporters, strengthening its aftermarket footprint.

Key Challenges Facing the Market

Environmental Regulations and Recycling Pressures

Although lead-acid batteries are highly recyclable, improper recycling practices can result in environmental contamination. Governments worldwide are tightening regulations related to lead handling and emissions.

Manufacturers must invest in advanced recycling infrastructure and cleaner production technologies. While closed-loop recycling systems are increasingly adopted, compliance across different regulatory environments remains complex and capital intensive.

Balancing environmental responsibility with cost competitiveness will determine long-term sustainability.

Competition from Lithium-Ion and Emerging Technologies

The rapid growth of electric vehicles (EVs) has intensified competition from lithium-ion batteries, which offer:

· Higher energy density

· Lighter weight

· Longer lifespan

Additionally, emerging technologies such as sodium-ion and solid-state batteries are narrowing the cost gap.

Despite this competition, lead-acid batteries retain strong positions in SLI and auxiliary systems. Strategic innovation and diversification will be critical for maintaining relevance in a shifting technological landscape.

Segment Analysis

Light-Duty Vehicles

Light-duty vehicles—including passenger cars and SUVs—represent the largest segment. These vehicles depend on lead-acid batteries for starting and auxiliary functions.

Global passenger vehicle recovery post-pandemic continues to sustain demand. Advanced AGM and EFB technologies are increasingly used in start-stop systems, reinforcing the segment’s importance.

Medium-Duty Vehicles

Medium-duty vehicles such as delivery vans and buses require batteries capable of handling heavy electrical loads and frequent engine starts. Lead-acid batteries remain the preferred solution due to reliability and affordability.

Growth in e-commerce and logistics has expanded this segment, increasing battery demand for commercial fleets.

Aftermarket Segment

The aftermarket remains one of the most stable and predictable segments. Seasonal demand spikes—particularly during cold weather—drive replacement rates.

Digital diagnostic tools are improving early detection of battery wear, enhancing service efficiency and consumer confidence.

Fiber Lead-Acid Batteries

Fiber-reinforced components are being integrated into battery separators and casings to enhance durability and reduce weight. These improvements contribute to better fuel efficiency and vibration resistance.

Lightweight design innovations align with broader automotive sustainability goals.

Rubber Lead-Acid Batteries

Rubber components improve sealing, insulation, and shock absorption. These batteries are especially valuable in off-road and heavy-duty applications where vibration and temperature fluctuations are extreme.

Enhanced safety and corrosion resistance make rubber-reinforced batteries suitable for demanding environments.

Regional Market Insights

United States

The United States represents a mature and technologically advanced market. A large automotive fleet and high replacement rates drive strong demand.

Manufacturers continue investing in AGM and EFB batteries to meet fuel-efficiency and emission standards. In May 2025, GS Yuasa Battery Ltd. announced the renewed launch of its ECO.R Revolution battery series for idling stop systems.

France

France emphasizes sustainability and regulatory compliance. Strict EU environmental standards encourage advanced recycling and cleaner production.

In July 2024, Stellantis and CEA announced a five-year collaboration to develop next-generation EV battery cells with improved performance and reduced carbon footprint.

China

China remains the global leader in lead-acid battery production due to its extensive manufacturing infrastructure. Strong domestic vehicle demand and economies of scale drive cost efficiency.

In April 2025, CATL launched Naxtra sodium-ion batteries alongside its second-generation Shenxing fast-charging EV battery, signaling intensified competition from alternative chemistries.

Saudi Arabia

Saudi Arabia’s growing vehicle ownership and extreme climate conditions create demand for heat-resistant batteries.

In May 2025, Saudi Aramco commissioned a megawatt-scale renewable energy storage system using iron-vanadium flow battery technology, highlighting innovation in energy storage across the region.

Market Segmentation Overview

By Type:

Lower Quarter Panels

Door Rocker Panels

By Vehicle Type:

Light-Duty Vehicles

Medium-Duty Vehicles

Heavy-Duty Vehicles

By Sales Channel:

Aftermarket

OEMs

By Material:

Stainless Steel

Fiber

Rubber

By Region:

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Competitive Landscape

Key players analyzed in the report include:

· Auto Metal Direct LLC

· Classic 2 Current Fabrication

· Putco Inc.

· Rugged Ridge

· Smittybilt

· SMP Deutschland GmbH

· Willmore Manufacturing Inc.

Each company is assessed through five viewpoints: overview, key personnel, recent developments, SWOT analysis, and revenue analysis.

Final Thoughts

Despite the rapid acceleration of electric mobility and emerging battery chemistries, the automotive lead-acid battery market remains resilient and essential. Projected to grow from US$ 12.54 billion in 2024 to US$ 15.90 billion by 2033 at a CAGR of 2.67%, the market reflects steady demand supported by vehicle production, replacement cycles, and auxiliary system integration.

While environmental regulations and lithium-ion competition present long-term challenges, lead-acid batteries continue to offer unmatched cost efficiency, recyclability, and reliability. Through technological refinement and strategic adaptation, the industry is positioned to maintain relevance in the evolving global automotive ecosystem.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar