-

Newsfeed

- ERKUNDEN

-

Seiten

-

Gruppen

-

Veranstaltungen

-

Reels

-

Blogs

-

Marktplatz

-

Jobs

Texas Paycheck Calculator: Accurately Estimate Your Take-Home Salary

Moving to or working in Texas comes with many financial advantages, including no state income tax. However, that does not mean your paycheck equals your full salary. Federal taxes, Social Security, Medicare, insurance deductions, and retirement contributions still apply. That’s why using a texas paycheck calculator is essential for employees, executives, and employers alike.

Whether you are starting a new job, negotiating a salary package, or planning your monthly expenses, understanding your actual take-home pay helps you make smarter financial decisions.

Why You Need a Texas Paycheck Calculator

Texas is known for its business-friendly environment and growing job market. Many professionals relocate here for better opportunities. But while the state does not charge income tax, your paycheck still includes mandatory federal deductions.

A texas paycheck calculator helps you:

-

Estimate net (take-home) pay

-

Understand federal tax deductions

-

Calculate Social Security and Medicare contributions

-

Plan benefits and retirement deductions

-

Compare job offers accurately

Instead of guessing what you will receive after taxes, you can calculate it within seconds and plan accordingly.

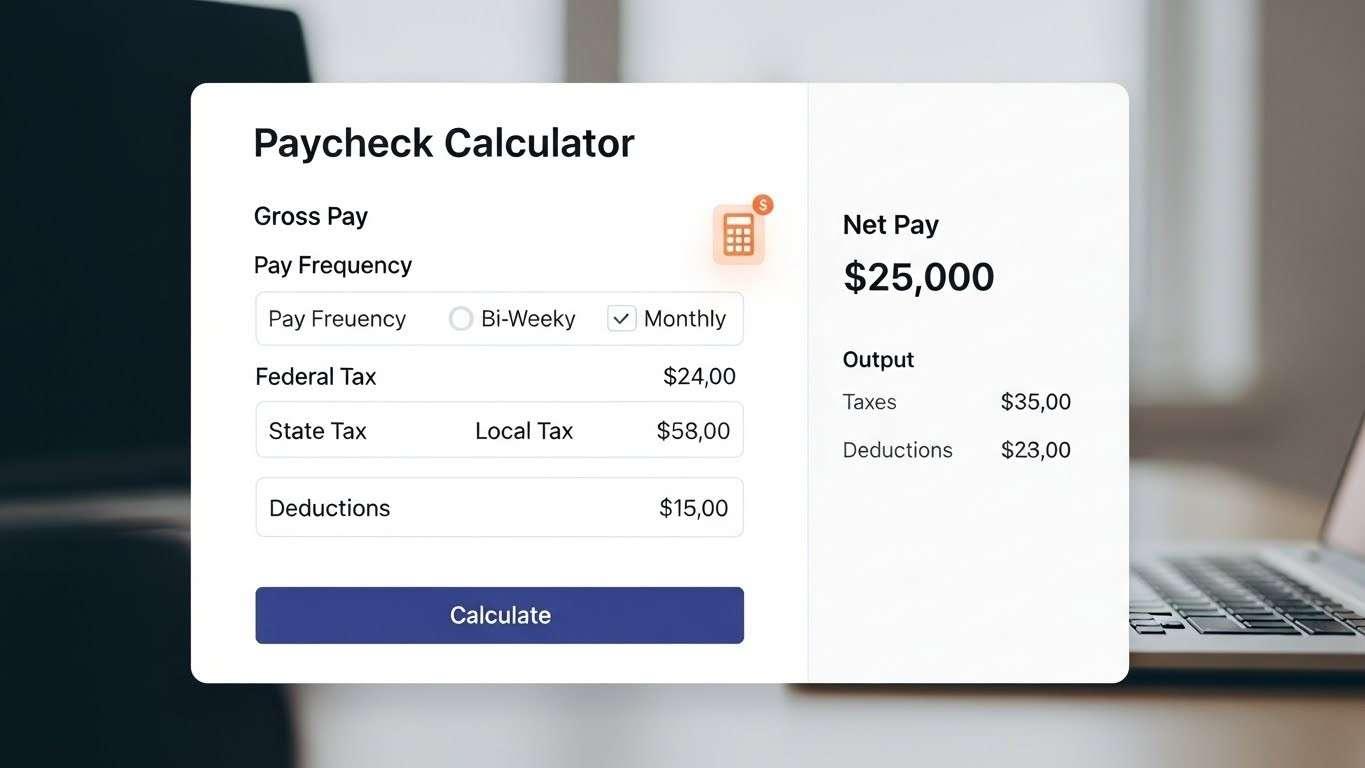

How the Texas Paycheck Calculator Works

A reliable texas paycheck calculator typically asks for:

-

Gross salary (annual or hourly)

-

Pay frequency (weekly, biweekly, monthly)

-

Filing status (single, married, head of household)

-

Federal withholding details

-

Additional deductions (401k, health insurance, etc.)

After entering these details, the calculator instantly provides an estimate of your net pay.

Because Texas has no state income tax, calculations are slightly simpler compared to states like California or New York. However, federal tax brackets still significantly impact your final paycheck.

Benefits for Employees and Executives

Professionals at every level benefit from using a texas paycheck calculator. But for executives and senior leaders, accurate salary projections are even more important.

High-income earners often have:

-

Performance bonuses

-

Stock options

-

Deferred compensation

-

Retirement contributions

-

Complex benefit structures

Before accepting a leadership position, executives should calculate how much they will actually receive after taxes and deductions. This is especially important when negotiating compensation packages through an executive employment agency.

An executive employment agency typically assists high-level professionals in securing roles such as CEO, CFO, COO, or CTO. During salary negotiations, understanding real take-home income provides stronger leverage and clearer expectations.

Employers and HR Departments Also Benefit

Companies in Texas can use a texas paycheck calculator to:

-

Offer transparent salary breakdowns

-

Help candidates understand compensation

-

Avoid payroll misunderstandings

-

Improve employee satisfaction

When working with an executive employment agency, companies often present attractive salary packages. Providing clear net salary estimates builds trust with potential hires and reduces confusion during onboarding.

Comparing Job Offers in Texas

Texas cities like Austin, Dallas, Houston, and San Antonio offer competitive salaries across industries including tech, healthcare, energy, and finance.

If you receive multiple job offers, a texas paycheck calculator helps you compare:

-

Base salary differences

-

Bonus structures

-

Health insurance costs

-

Retirement contributions

-

After-tax income

Sometimes a higher gross salary does not necessarily mean higher take-home pay. Deductions and benefits can significantly change the final amount deposited into your account.

Financial Planning Made Easier

Budgeting becomes easier when you know your exact net income. With the help of a texas paycheck calculator, you can:

-

Plan monthly expenses

-

Calculate mortgage affordability

-

Estimate savings potential

-

Set realistic financial goals

Executives relocating through an executive employment agency often need detailed financial planning before moving. Housing costs, lifestyle changes, and investment strategies all depend on accurate income calculations.

Understanding Federal Deductions in Texas

Even though Texas does not impose state income tax, federal deductions still include:

-

Federal Income Tax

-

Social Security (6.2%)

-

Medicare (1.45%)

-

Additional Medicare tax for high earners

For executives earning higher salaries, federal tax brackets increase progressively. This makes using a texas paycheck calculator even more important for high-income professionals.

Why Executives Should Pay Extra Attention

Senior professionals recruited through an executive employment agency often receive compensation packages that include bonuses and incentives.

Without proper calculation, executives may:

-

Underestimate tax liability

-

Miscalculate quarterly tax payments

-

Overestimate disposable income

-

Make poor financial commitments

A texas paycheck calculator eliminates uncertainty and supports smarter financial decisions.

Final Thoughts

Texas continues to attract talent from across the United States due to its strong economy and tax advantages. However, understanding your true earnings requires more than looking at your gross salary.

A texas paycheck calculator provides clarity, transparency, and confidence when planning your finances or negotiating compensation. Whether you are an employee reviewing a new offer or an executive working with an executive employment agency, knowing your accurate take-home pay is essential.

Before signing your next employment contract in Texas, take a few minutes to calculate your net salary. That small step can make a significant difference in your financial planning and long-term success.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar