Saudi Arabia Air Purifier Market Insights and Future Outlook 2025

Saudi Arabia Air Purifier Market Size and Forecast 2025–2033

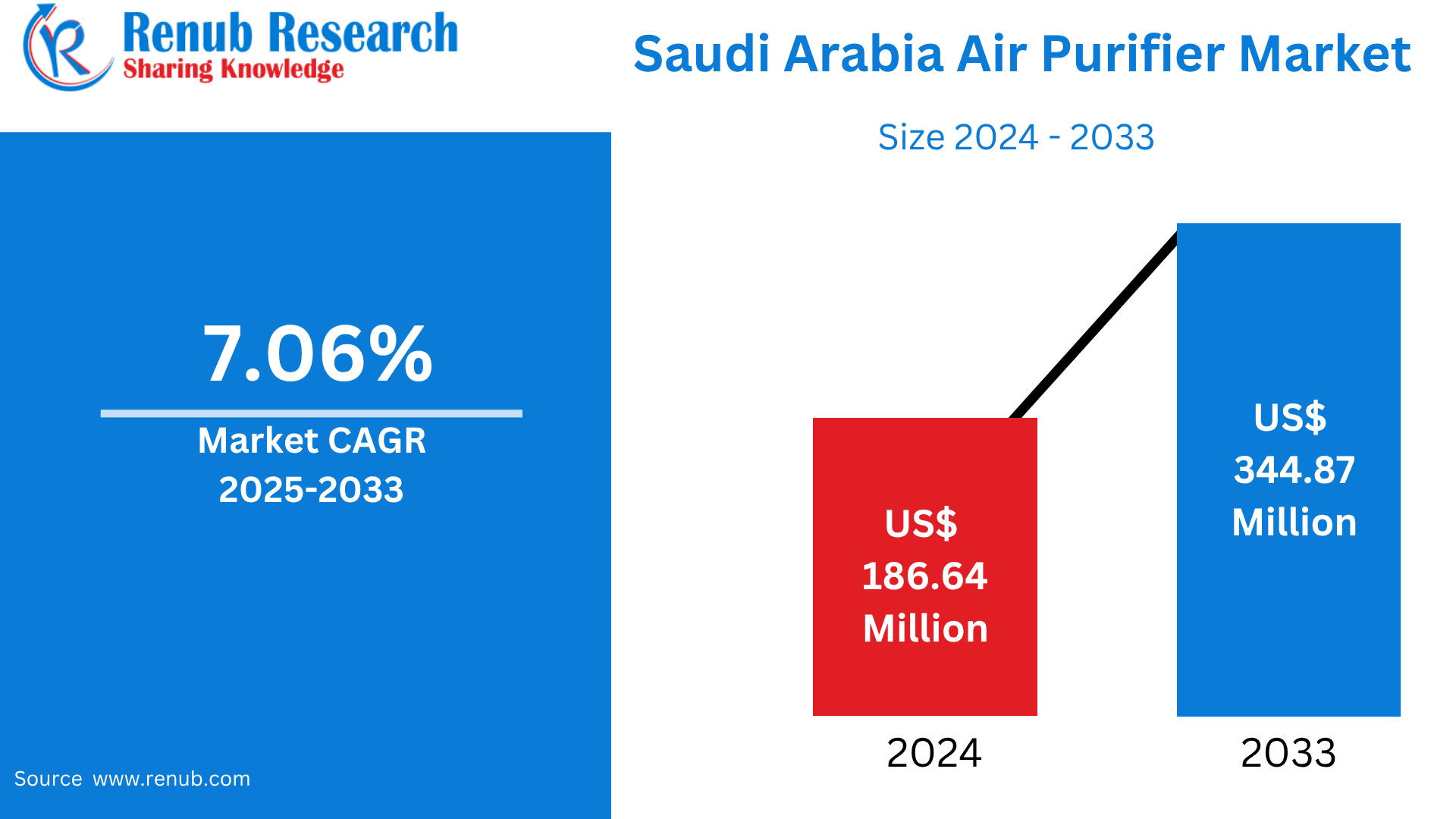

According To Renub Research Saudi Arabia air purifier market is witnessing robust growth, driven by rising air pollution levels, increasing public awareness regarding health and wellness, and expanding demand for indoor air quality solutions across residential, commercial, and industrial sectors. The market was valued at US$ 186.64 million in 2024 and is projected to reach US$ 344.87 million by 2033, registering a compound annual growth rate (CAGR) of 7.06% during the forecast period from 2025 to 2033. This upward trajectory reflects the Kingdom’s evolving environmental priorities, rapid urbanization, and the growing emphasis on preventive healthcare and sustainable living environments.

Saudi Arabia Air Purifier Market Overview

An air purifier is a device designed to remove contaminants from indoor air, thereby improving overall air quality and reducing health risks. These devices typically utilize filtration technologies such as HEPA filters, activated carbon filters, ionic filters, and electrostatic precipitators to capture dust, allergens, smoke, bacteria, viruses, and volatile organic compounds. Air purifiers are particularly beneficial for individuals suffering from asthma, allergies, or other respiratory conditions.

In Saudi Arabia, the demand for air purifiers has increased significantly due to persistent air quality challenges caused by frequent dust storms, industrial emissions, construction activity, and vehicular pollution. The country’s desert climate contributes to high levels of airborne particulate matter, making indoor air purification a necessity rather than a luxury. Post-pandemic health awareness has further accelerated adoption, as households and organizations prioritize cleaner and safer indoor environments. Government initiatives promoting environmental sustainability and the availability of energy-efficient and smart air purification systems have also supported market expansion across major urban centers.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=saudi-arabia-air-purifier-market-p.php

Growing Levels of Air Pollution

One of the most influential growth drivers in the Saudi Arabia air purifier market is the rising level of air pollution. Cities such as Riyadh, Jeddah, and Dammam experience frequent dust storms combined with emissions from industrial operations and dense traffic. Rapid urbanization and large-scale infrastructure projects further contribute to declining air quality, increasing exposure to fine particulate matter and other pollutants.

As awareness of the health risks associated with indoor air pollution grows, consumers and institutions are increasingly adopting air purifiers as a preventive health measure. Advanced technologies such as HEPA filtration and ionic systems are in high demand due to their effectiveness in capturing fine dust and airborne allergens. Elevated pollution levels have made air purifiers an essential component in homes, offices, healthcare facilities, and educational institutions, driving consistent demand across the Kingdom.

Government Initiatives and Vision 2030

Saudi Arabia’s Vision 2030 plays a pivotal role in shaping the air purifier market. The national development framework emphasizes environmental protection, public health improvement, and enhanced quality of life. Policies aimed at reducing pollution, promoting sustainable infrastructure, and improving indoor environmental standards have created favorable conditions for the adoption of air purification technologies.

Public buildings, hospitals, schools, and government offices are increasingly focusing on indoor air quality compliance, leading to higher demand for commercial and in-duct air purifiers. Incentives for energy-efficient appliances and green technologies further encourage consumers and organizations to invest in modern air purification systems. Alignment with Vision 2030 has also attracted international manufacturers and encouraged innovation within the market.

Increasing Health Awareness Among Consumers

Health consciousness among Saudi consumers has risen sharply in recent years, particularly in the wake of the COVID-19 pandemic. There is growing recognition of the link between indoor air quality and respiratory health, allergies, and overall well-being. This awareness has driven demand for air purifiers in both residential and commercial spaces.

Rising disposable incomes and lifestyle changes have further supported spending on wellness-oriented products. Urban, tech-savvy, and health-focused consumers in cities such as Riyadh, Jeddah, and Dhahran are leading adoption trends. Air purifiers are increasingly viewed as long-term health investments rather than optional appliances, contributing to sustained market growth.

High Product Costs and Limited Rural Awareness

Despite strong growth in urban regions, high product prices remain a challenge for broader market penetration. Advanced air purifiers with multi-stage filtration and smart features require significant upfront investment, which can deter middle-income consumers. Maintenance costs, including filter replacements, further add to the total cost of ownership.

In rural and less-developed areas, limited awareness about the benefits of air purifiers and restricted access to retail channels hinder adoption. Offline availability is often concentrated in major cities, leaving smaller towns underserved. To overcome these barriers, manufacturers and distributors need to focus on affordable product lines, awareness campaigns, and expanded distribution networks.

Dependence on Imports and Limited Local Manufacturing

Saudi Arabia relies heavily on imported air purifiers and components, primarily from Asia, Europe, and North America. Import duties, shipping costs, and currency fluctuations contribute to higher retail prices. Supply chain disruptions can also affect product availability and delivery timelines.

The lack of strong local manufacturing capabilities limits customization of air purification solutions tailored to Saudi Arabia’s unique environmental conditions, such as extreme dust exposure. Developing local production and assembly facilities could help reduce costs, improve supply chain resilience, and foster innovation aligned with regional needs.

Saudi Arabia In-Duct and Fixed Air Purifier Market

The in-duct or fixed air purifier segment is gaining traction, particularly in commercial buildings, hospitals, and high-end residential developments. These systems are integrated into HVAC units, providing continuous air purification throughout entire buildings. Given the Kingdom’s climate, where indoor environments dominate daily life, centralized air purification offers an efficient and scalable solution.

Regulatory focus on healthy buildings and energy efficiency has encouraged real estate developers and facility managers to adopt fixed systems. In-duct air purifiers are increasingly preferred for their long-term operational efficiency, lower maintenance needs, and ability to deliver consistent indoor air quality across large spaces.

Saudi Arabia HEPA Air Purifier Market

HEPA air purifiers are among the most popular technologies in Saudi Arabia due to their proven ability to capture fine particulate matter, dust, pollen, and allergens. These systems are particularly effective against desert dust, a major air quality concern in the region.

Healthcare facilities, schools, and households with respiratory-sensitive occupants show strong preference for HEPA-based systems. Continuous innovation in compact, energy-efficient HEPA models has further boosted adoption. As consumers increasingly favor scientifically validated technologies, the HEPA segment remains a leading contributor to overall market revenue.

Saudi Arabia Ionic Filter Air Purifier Market

Ionic filter air purifiers attract consumers seeking low-noise operation and minimal maintenance. These devices release negatively charged ions that bind with airborne particles, causing them to settle out of the air. Their effectiveness against ultrafine dust makes them appealing in Saudi Arabia’s dusty environment.

Modern homes and offices favor ionic purifiers for their sleek design and lack of frequent filter replacement. However, regulatory scrutiny regarding ozone emissions and long-term health effects may limit growth. Despite these concerns, the segment continues to attract technology-oriented consumers looking for compact air purification solutions.

Saudi Arabia Commercial Air Purifier Market

The commercial air purifier segment is expanding rapidly due to stricter indoor air quality standards and heightened hygiene expectations. Offices, malls, hotels, airports, schools, and healthcare facilities are increasingly installing air purification systems to ensure safe environments for employees and visitors.

Tourism, entertainment, and hospitality growth under Vision 2030 further supports demand for commercial air purifiers. In-duct and freestanding units with smart monitoring features are particularly popular. Government regulations mandating air quality compliance in public spaces continue to strengthen this segment’s growth outlook.

Saudi Arabia Residential Air Purifier Market

Residential adoption of air purifiers is accelerating, especially among urban households. Rising exposure to dust, allergens, and pollution has prompted consumers to invest in multi-stage filtration systems for daily use. Smart features such as app connectivity, air quality sensors, and integration with home automation systems are increasingly influencing purchasing decisions.

Compact designs, aesthetic appeal, and improved energy efficiency also enhance consumer interest. The expansion of e-commerce platforms has improved product accessibility beyond major cities, supporting further growth in the residential segment.

Saudi Arabia Offline Air Purifier Market

Offline retail channels remain highly relevant in the Saudi Arabia air purifier market. Many consumers prefer to physically examine products, compare features, and receive in-store demonstrations before making a purchase. Offline channels also provide after-sales support, installation services, and brand assurance.

Retail stores and authorized dealers play a crucial role in educating consumers and promoting premium products. Despite the growth of online sales, offline distribution continues to account for a substantial share of market revenue due to trust and immediacy factors.

Dhahran Air Purifier Market

Dhahran, located in the Eastern Province, experiences significant air pollution due to oil and gas operations. This has led to strong demand for air purifiers in commercial facilities and high-income residential areas. A health-aware expatriate population and corporate presence further support adoption of advanced air purification systems.

In-duct solutions are increasingly deployed in corporate offices, hospitals, and educational institutions. Dhahran’s modern infrastructure and exposure to global standards make it an attractive market for premium air purifier brands.

Jeddah Air Purifier Market

Jeddah faces unique air quality challenges related to coastal humidity, industrial emissions, and dust. As a major commercial and hospitality hub, the city shows strong demand for air purifiers in hotels, shopping malls, and residential complexes.

Health-conscious consumers and government initiatives promoting indoor air quality have driven adoption of HEPA and smart air purifiers. Growing online retail activity has also expanded consumer access to a wide range of air purification solutions in Jeddah.

Riyadh Air Purifier Market

Riyadh represents the largest and most dynamic air purifier market in Saudi Arabia. High population density, vehicle emissions, and frequent dust exposure drive demand across residential, commercial, and institutional segments. Consumers in Riyadh are early adopters of smart and energy-efficient air purifiers.

Government-led environmental health initiatives and strong distribution networks further support market growth. With educated consumers and advanced retail infrastructure, Riyadh leads the Kingdom in both market size and innovation adoption.

Market Segmentation and Competitive Landscape

The Saudi Arabia air purifier market is segmented by type, technology, application, distribution channel, and region. Product types include standalone or portable units and in-duct or fixed systems. Technologies encompass HEPA, activated carbon, ionic filters, electrostatic precipitators, and others. Applications span residential, commercial, and industrial sectors, while distribution channels include offline and online sales.

Key market participants include Daikin Industries Ltd, IQAir, Whirlpool Corporation, Panasonic Corporation, Xiaomi Corp, Sharp Corporation, Koninklijke Philips NV, and LG Electronics Inc.. These companies compete through product innovation, energy efficiency, smart features, and regional expansion. Competitive analysis typically includes company overviews, leadership insights, recent developments, SWOT analysis, and revenue performance, highlighting a rapidly evolving and opportunity-rich market.

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar