US AI Server Market Report 2026–2034 by Type & Cooling

United States AI Server Market Size and Forecast 2026–2034

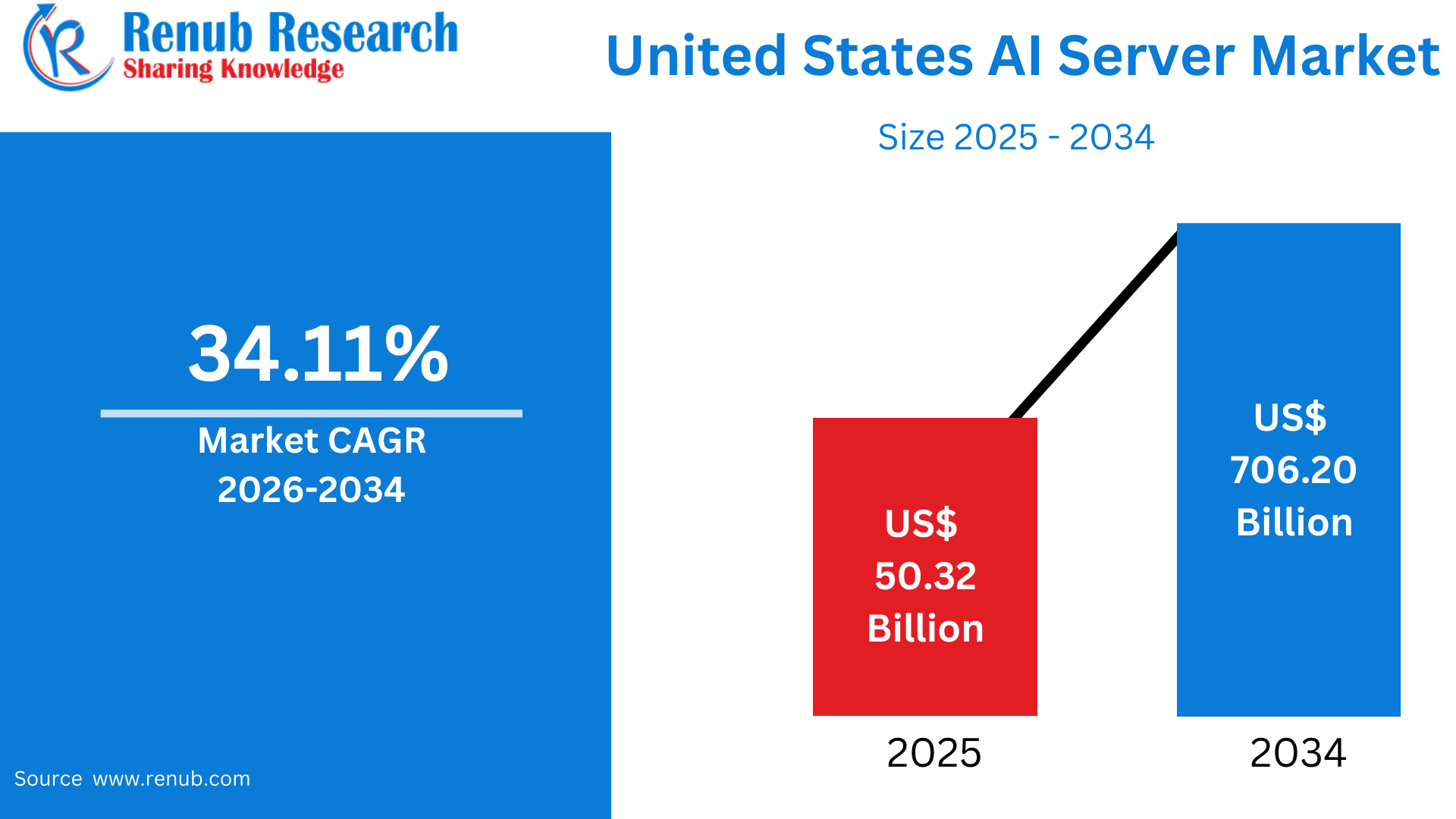

According To Renub Research United States AI server market is entering a phase of unprecedented expansion, reflecting the country’s leadership in artificial intelligence innovation, cloud computing, and advanced digital infrastructure. The market is projected to grow from US$ 50.32 billion in 2025 to an estimated US$ 706.20 billion by 2034, registering a remarkable compound annual growth rate (CAGR) of 34.11% during the period from 2026 to 2034. This rapid acceleration is driven by the explosive growth of artificial intelligence workloads across hyperscale data centers, cloud platforms, and enterprise IT environments.

The increasing deployment of generative AI, high-performance computing (HPC), big data analytics, and accelerator-based server architectures has positioned AI servers as foundational infrastructure within the U.S. digital economy. As organizations shift AI from experimentation to mission-critical production systems, demand for scalable, high-performance AI server platforms continues to surge.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-ai-server-market-p.php

United States AI Server Market Overview

An AI server is a specialized high-performance computing system engineered to handle artificial intelligence workloads such as machine learning, deep learning, natural language processing, computer vision, and generative AI. Unlike traditional servers, AI servers are equipped with advanced accelerators, including GPUs, TPUs, FPGAs, or ASICs, enabling massive parallel processing of large datasets at extremely high speeds. These servers also integrate high-bandwidth memory, ultra-fast storage, and low-latency networking to support both training and inference workloads efficiently.

In the United States, AI servers are widely deployed across data centers, cloud service platforms, research institutions, and enterprise environments. The country’s strong ecosystem of technology companies, startups, academic institutions, and government research agencies has made AI servers a core enabler of innovation. Growing adoption of AI across healthcare, finance, retail, defense, manufacturing, and autonomous systems continues to reinforce the importance of AI server infrastructure as a strategic national asset.

Key Growth Drivers in the United States AI Server Market

Explosion of AI Adoption Across Industries

The rapid adoption of AI across nearly all major industry verticals is one of the most powerful drivers of the U.S. AI server market. Enterprises are increasingly deploying AI for recommendation engines, fraud detection, predictive maintenance, demand forecasting, and automation. This transition from pilot projects to full-scale production requires robust, scalable AI server infrastructure capable of supporting continuous workloads and real-time inference.

At the same time, the exponential growth of data generated by IoT devices, digital platforms, and enterprise systems is forcing organizations to invest in in-house or hybrid AI infrastructure to process data more securely and efficiently. GPU-accelerated servers have become the backbone of this transformation, as their architecture is well suited to parallel computation. Market leadership by NVIDIA Corporation has further reinforced GPU-based servers as the dominant choice for AI workloads in the United States.

Generative AI and Large Language Models

The emergence of generative AI and large language models (LLMs) represents a structural shift in computing demand and is a major growth engine for the U.S. AI server market. Training and fine-tuning large models require enormous compute density, high-bandwidth memory, and fast interconnects, all of which are delivered by advanced AI servers.

Enterprises increasingly seek to customize foundation models using proprietary datasets, which drives demand for dedicated or hybrid AI server deployments rather than exclusive reliance on public cloud platforms. Inference workloads are also expanding rapidly as LLMs are embedded into productivity tools, customer support systems, software development workflows, and content generation platforms. This combination of large-scale training and persistent inference has resulted in massive investment in dense AI server clusters across U.S. data centers.

Government, Regulation, and Security Considerations

Government policy, regulatory frameworks, and national security concerns are indirectly fueling AI server investments in the United States. Sensitive use cases involving defense, healthcare records, financial data, and intellectual property often require on-premises or sovereign AI infrastructure rather than shared public cloud environments.

Stricter regulations around data privacy, AI governance, transparency, and auditability are pushing organizations to deploy dedicated AI servers within controlled environments. In parallel, new cybersecurity mandates are driving the adoption of AI-powered security analytics and threat detection systems, which depend on high-performance computing infrastructure. Federal funding for AI research, semiconductor manufacturing, and critical digital infrastructure further accelerates the domestic build-out of AI-focused data centers.

Challenges in the United States AI Server Market

High Capital and Operating Costs

Despite strong demand, high capital and operational costs remain a significant challenge in the U.S. AI server market. Advanced GPU- and accelerator-based AI servers are expensive, and large-scale deployments require substantial investments in networking, storage, power delivery, and cooling infrastructure. For many enterprises, justifying these upfront costs can be difficult, particularly when AI use cases are still evolving or returns on investment are uncertain.

Operational expenses also present challenges. AI servers consume significantly more power and generate more heat than traditional servers, increasing electricity costs and placing strain on cooling systems. Data centers often require upgrades to power distribution, redundancy, and thermal management, which can extend deployment timelines and increase overall project costs.

Skills Shortages and Integration Complexity

Another key challenge is the shortage of skilled professionals capable of deploying and managing AI server environments. Successful AI infrastructure requires expertise in machine learning frameworks, distributed computing, container orchestration, and high-performance networking. Integrating AI servers into legacy IT systems can be complex, particularly when existing storage, data pipelines, and security architectures are not optimized for AI workloads.

As a result, some organizations experience underutilized AI servers, prolonged implementation timelines, or stalled pilot projects, which can dampen confidence and slow adoption despite strong long-term demand.

United States GPU-Based AI Server Market

GPU-based AI servers represent the largest and most dominant segment of the U.S. AI server market. GPUs are the primary engines for training and inference of deep learning and generative AI models due to their massively parallel processing capabilities and mature software ecosystem. Hyperscalers, SaaS providers, and large enterprises standardize on GPU-accelerated platforms to support widely used frameworks such as PyTorch and TensorFlow, as well as proprietary AI toolchains.

Continuous innovation in GPU architecture, interconnects, and memory bandwidth ensures that GPU-based servers remain central to AI infrastructure strategies across the United States.

United States ASIC-Based AI Server Market

ASIC-based AI servers are emerging as a high-efficiency alternative for specific, predictable AI workloads. These custom-designed chips are optimized for targeted applications such as inference, recommendation engines, and video analytics. Their primary advantage lies in superior performance-per-watt and lower total cost of ownership at scale.

Large cloud providers and internet companies are early adopters of ASIC-based AI servers, often designing proprietary accelerators tailored to their platforms. While this segment is smaller than GPU-based servers, it is expected to grow steadily as AI workloads become more specialized.

United States Cooling Technology Trends in AI Servers

Air cooling remains the most widely deployed thermal management solution in U.S. AI data centers, particularly within existing facilities. Its familiarity and lower upfront cost make it suitable for moderate-density deployments. However, as rack densities increase, hybrid and liquid cooling solutions are gaining traction.

Hybrid cooling, which combines air and liquid cooling methods, is becoming increasingly popular for high-density AI workloads. By enabling higher rack power levels without complete infrastructure overhauls, hybrid cooling provides a practical transition path for data centers supporting next-generation AI servers.

United States AI Server Form Factor Analysis

AI blade servers appeal to enterprises seeking dense, modular compute in space-constrained environments. Blade architectures simplify management by sharing power, cooling, and networking resources across multiple nodes. In contrast, AI tower servers serve edge locations and smaller enterprises that require localized AI processing without full data center infrastructure.

Rack-mounted AI servers remain the most common form factor, offering flexibility and scalability for hyperscale and enterprise data centers.

End-Use Industry Analysis of the United States AI Server Market

The BFSI sector relies heavily on AI servers for fraud detection, risk modeling, algorithmic trading, and customer personalization, often deploying on-premises infrastructure to meet regulatory requirements. Healthcare and pharmaceutical organizations use AI servers for imaging diagnostics, genomics, drug discovery, and clinical decision support, where data privacy and compute intensity are critical.

In the automotive sector, AI servers are essential for training autonomous driving models, running simulations, and supporting connected vehicle ecosystems. Retail, telecommunications, and manufacturing industries also continue to expand AI server adoption to improve efficiency, personalization, and automation.

State-Level Outlook of the United States AI Server Market

California serves as the epicenter of the U.S. AI server market, driven by hyperscalers, AI startups, and semiconductor companies concentrated in Silicon Valley and surrounding regions. New York’s market is anchored by financial services, media, and advertising technology firms that rely on low-latency AI infrastructure. Texas is rapidly emerging as a major AI server hub due to favorable energy economics, abundant land, and large-scale data center investments.

Other states continue to expand AI server deployments as enterprises decentralize infrastructure and pursue regional resilience.

Competitive Landscape of the United States AI Server Market

The competitive landscape features a mix of global technology leaders and specialized infrastructure providers. Key companies include Dell Inc., Cisco Systems, Inc., IBM Corporation, HP Development Company, L.P., Super Micro Computer, Inc., and Lenovo Group Limited. These firms compete through innovation in server architecture, cooling efficiency, accelerator integration, and end-to-end AI infrastructure solutions.

Conclusion

The United States AI server market is poised for extraordinary growth through 2034, driven by widespread AI adoption, the rise of generative AI, and increasing demand for secure, high-performance computing infrastructure. While high costs and integration complexity present challenges, continued innovation, government support, and expanding enterprise use cases will sustain long-term momentum. AI servers are set to remain a cornerstone of the U.S. technology ecosystem, underpinning the next decade of digital and economic transformation.

Top of Form

Bottom of Form

- Arte

- Causas

- Artesanía

- Bailar

- Bebidas

- Película

- Fitness

- Alimento

- Juegos

- Jardinería

- Salud

- Hogar

- Literatura

- Musica

- Redes

- Otro

- Fiesta

- Religión

- Compras

- Deportes

- Teatro

- Bienestar